To bring security and prosperity to families and businesses through a thoughtful understanding of their needs and aspirations.

Benefits Of Working with The Financial Planning Group:

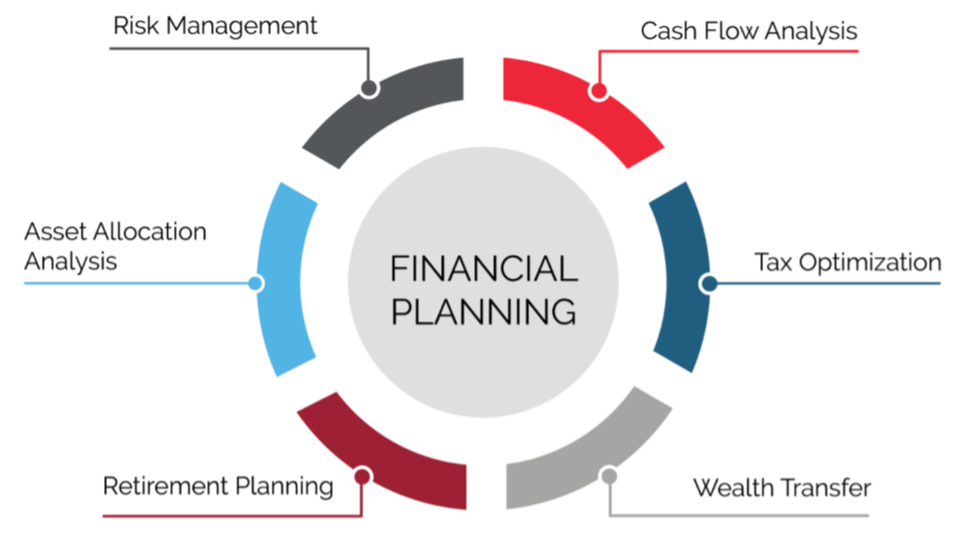

We’ll work with you to gain a deep understanding of your goals, values, and concerns so that together, we can create and implement a comprehensive financial plan to help you achieve your current and future goals.

Have a question or need more information about Financial Planning? We’re here to help.

The Financial Planning Group is committed to the highest level of ethical standards. Many of our team members are CERTIFIED FINANCIAL PLANNERS™, and as part of CFP® certification, all CFP® professionals commit to the CFP® Board to uphold the high standards outlined in the Code of Ethics and Standards of Conduct.