The Financial Planning Group can add clarity to client questions such as:

- How much do I need to save?

- How should I manage current debt vs investing?

Based on a cash flow analysis, we can deliver actionable insights that help you make informed decisions at key turning points in your financial life.

- How should I be invested?

- Which investments should be held in which accounts?

Someone’s sitting in the shade today because someone planted a tree a long time ago.

Someone’s sitting in the shade today because someone planted a tree a long time ago.

- Warren Buffet

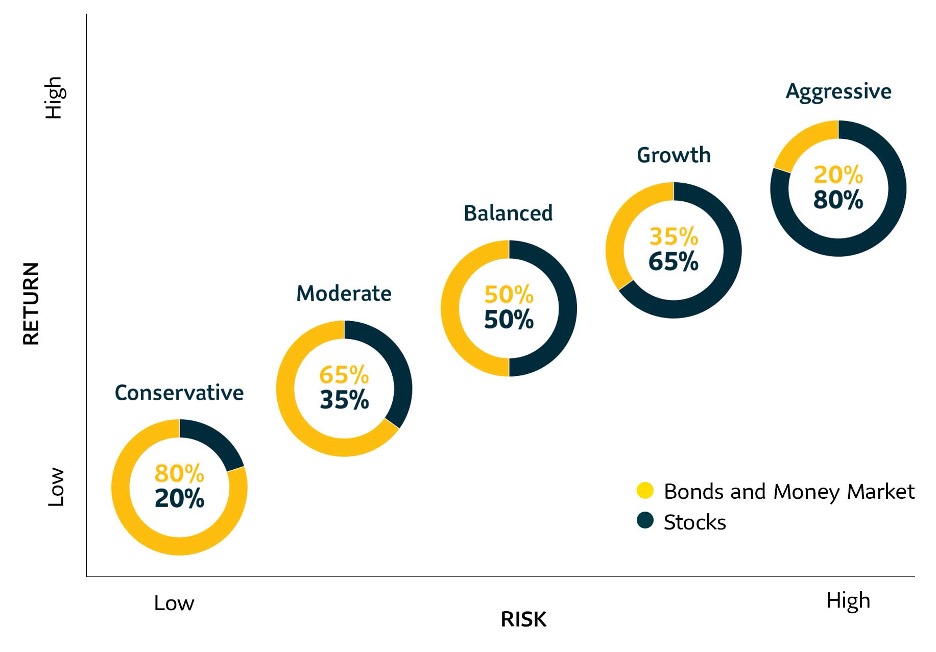

Risk and reward in your investments

We help clients understand the relationship between risk and reward in their investments, coupled with a deep understanding of time frames, risk tolerances and other qualitative data.

- Do I need insurance? How much?

- What if I become disabled, or die prematurely?

We provide an insurance coverage review, including Life, Disability and Long Term Care.

- How do I prepare for retirement?

Understanding how to replace your pre-retirement paycheck in a tax efficient manner can build confidence in financial longevity. This includes a full analysis of pensions, rental income, annuities, royalties, and executive compensation in conjunction with distributions from your portfolio.

- What are my options to save for College expenses?

- Do I need an Estate Plan?

We provide education on estate planning concepts. Our Fiduciary Team can help review your Will, Trust, Power of Attorney, Medical Directive, and Healthcare Proxy. We work with our clients’ attorneys to develop gifting strategies, review the titling of assets, and make sure estate plans are current.

Get in touch

Have a question or need more information about Financial Planning? We’re here to help.