Key Takeaways

- Sustainable investing has moved beyond divestment and social issues to include environmental and governance factors.

- Our holistic approach considers both traditional fundamental analysis and environmental, social and governance factors in the portfolio construction process.

- The number of women serving on corporate boards of directors has increased in recent years, making boardroom diversity a common consideration among sustainable investors.

- Sustainable bond issuance has increased in recent years.

- The concept of sustainable investing continues to evolve as the world around us changes.

Sustainable investing integrates environmental, social, and governance (ESG) factors into investment decisions alongside traditional fundamental analysis. Cambridge Trust Wealth Management’s sustainable investing strategy was started in 2014, in response to client demand for portfolios that moved beyond divestment of certain industries and incorporated a broader consideration set of non-financial risk factors in the form of ESG metrics.

The History of Sustainable Investing

The roots of sustainable investing in the U.S. started in faith-based communities in the 1700s. Within the investment community, the Pioneer Fund, established in Boston in 1928, sought to avoid “sin” industries as part of its proposition to investors. Socially responsible investing experienced a resurgence in the 1960s, as protests over the Vietnam War took place and questions arose around corporate behavior. Divestment was the central theme of the 1980s when institutions and companies began to avoid investments with exposure to South Africa as anti-apartheid sentiment surged. Interest continued to grow in the 1990’s and the early 2000s, with the concept of sustainability becoming more prevalent as investors sought to move beyond social issues to include environmental and governance considerations in their investment framework.

Why It Matters

Sustainable investing today has entered the mainstream, embraced broadly by individuals, foundations, pension plans, and universities. The Forum for Sustainable & Responsible Investment’s (US SIF) 2024 trend report showed that $6.5 trillion in assets under management used some form of ESG criteria in the investment process. Sustainable investing isn’t just about values—it’s about resilience. Companies that manage ESG risks well may be better positioned for long-term success.

Sustainable Investing with Cambridge Trust

Within sustainable equity portfolios, we take a holistic approach in choosing investments, looking at fundamental characteristics of each prospective investment first then layering on our team’s analysis of ESG inputs. Our team of analysts works to identify companies that are market leaders with the potential for strong long-term risk adjusted returns. Beyond fundamental analysis, the sustainable investing team conducts research, evaluating parameters such as environmental capital management, board performance, product safety records, employee relations, and corporate governance. This gives a broader perspective on a company and may help to identify risks not found with traditional fundamental analysis.

Many of our clients have a portion of their portfolios invested in either municipal or taxable bonds. Similar to our equity research approach, our fixed income team uses a combination of traditional credit analysis and ESG factor assessment in their decision making.

Municipal bonds often naturally align with sustainability goals—think school districts, water providers, and affordable housing projects. When considering a bond for addition to a portfolio, our team focuses on metrics relevant to the issuer’s industry. As an example, when reviewing a bond issued by a school district, we may look at data on metrics surrounding graduation rates and student/ teacher ratios.

Timely Topics in Sustainable Investing

Since the founding of our strategy, much has changed within the sustainable universe.

Terminology

Names and descriptions within the world of sustainable investing have evolved over time. What was once referred to as socially responsible investing eventually became sustainable investing as investors sought to describe a style of investing that moved beyond just social parameters to include environmental issues and governance.

Impact investing is another popular term, as a broader description of investing that seeks to generate both a financial and social return.

Gender, racial, and ethnic representation

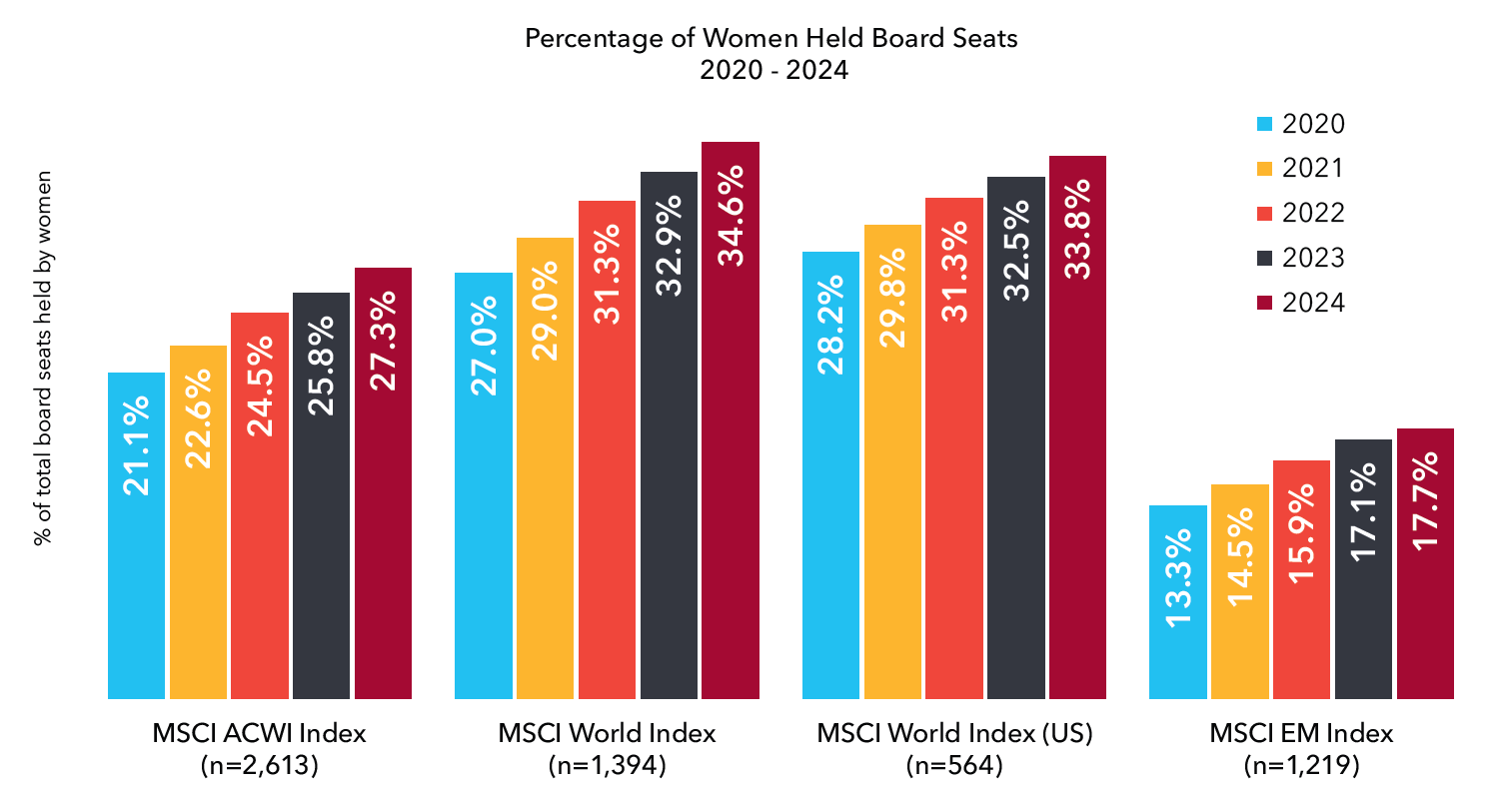

The number of women serving on corporate boards of directors has increased in recent years, making boardroom diversity a common consideration among sustainable investors. Per MSCI’s Women on Board and Beyond 2024 Progress Report, almost half of the companies comprising the MSCI All-Country World Index (ACWI) Index have at least 30% female representation of all active board seats.

Within executive management, however, the number of women serving in senior roles has seen less growth; only the healthcare sector had more than 10% of women serving as CEO.1 Board chair and CFO positions remained dominated by men. Diversity broken down by race and ethnicity has seen slower growth although underreporting may be a factor as disclosures are often limited.

![]() The number of women serving on corporate boards of directors has increased in recent years, making boardroom diversity a common consideration among sustainable investors.

The number of women serving on corporate boards of directors has increased in recent years, making boardroom diversity a common consideration among sustainable investors.![]()

- MSCI, October 2024

Data as of October 2024. This chart shows the overall percentage of director seats held by women from 2020 to 2024 among constituents of the MSCI ACWI, MSCI World, MSCI World (U.S. domiciled constituents only) and MSCI Emerging Markets Indexes (Index constituents as of October of each corresponding year). Includes only index constituents in our corporate governance research coverage. Boards of directors (one-tier board structure) and supervisory boards (two-tier board structure) are considered in this assessment. Source: MSCI ESG Research.AC

The Power Demands Associated with AI

As stocks linked to artificial intelligence (AI) have driven stock market gains over the past several years, concerns over the growing power needs associated with data centers is front-and-center. We have seen a resurgence in investments into nuclear energy, both through progress toward restarting of closed reactors and the gradual future introduction of small modular reactors that can be deployed broadly without the infrastructure requirements of traditional nuclear plants. Despite hurdles—both regulatory and political—the increasing adoption of renewable energy sources continues apace. The Deloitte Research Center for Energy and Industrials’ 2026 Renewable Energy Industry Outlook found that renewable energy projects accounted for 93% of gigawatt capacity growth through September 2025.

Supply Chain Management

Product sourcing is another hot topic with sustainable investors. Where a company sources inputs into their production process is a key consideration. In response, many companies now view their supply chain as an extension of their business operations and have adopted standards that their suppliers are asked to follow. As an example, the water services company Veralto has established a supplier policy that covers disparate items like business integrity, accounting, conflict minerals, international trade, and animal welfare among others.

Sustainable Bond Investing

While the focus of sustainable investing is often greater for stocks, the role of bonds in sustainable portfolios has increased in recent years, as debt issuance has grown to over $6 trillion per the Climate Bonds Initiative. These bonds can fall into a number of categories, including:

- Green bonds, whose proceeds are used to fund environmental projects, help issuers to meet environmental goals and initiatives. The first green bond was issued in 2007 by the European Investment Bank to finance climate-related projects. Examples include bond proceeds to increase renewables, improve water efficiency or recycling, remodel facilities to LEED standards and upgrade transportation systems. Corporations are the largest issuers of green bonds in the U.S., particularly companies in the utility and real estate sectors.

- Social bonds are issued to address specific social challenges or to fund a specific social outcome, including initiatives around infrastructure improvements, access to essential services, affordable housing and socioeconomic advancement. The social bond market is younger, dating back to 2013 when the International Finance Corporation began the "Banking on Women" bond program. Foundations may also issue social bonds for grantmaking. Recently, the Ford Foundation issued a social bond to fund organizations engaged in social justice.

- Sustainability bonds are general purpose bonds and may combine environmental and social projects into one issue.

- While some green bonds may focus on water projects, blue bonds are specifically designed to fund ocean or other water-related projects, including conservation and resource management.

Looking Ahead: The Future of Sustainable Investing

The concept of sustainable investing continues to evolve as the world around us changes. The dynamic nature of sustainability concepts (across environmental, social and governance factors) will change as technological winds shift (as in the cases of AI and nuclear power), as long-standing rules and regulations are amended, and as investor desires change and new areas of focus become more material. Throughout all of that change, the ongoing consideration of non-financial risk factors will continue to work alongside rigorous fundamental analysis to drive a more holistic approach to investment decision making.

If you are interested in learning more about sustainable investing and how we approach this subject, contact your Cambridge Trust Wealth Management team today.

1 Source: MSCI, October 2024

Views are as of December 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.