Economy & Markets

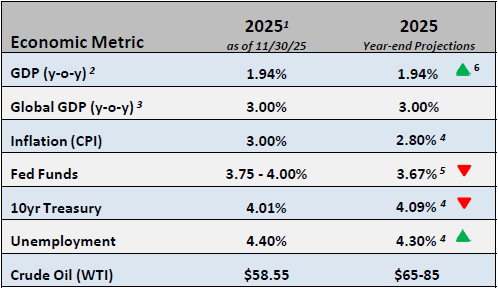

- The December Federal Reserve meeting resulted in another 25-basis point cut for the third time this year. The Fed now faces a difficult choice heading into the new year as they consider keeping rates elevated to combat stubborn inflation or continue down the path of lowering rates to buoy a softening employment market.

- Economic momentum appears to be strengthening as the year comes to an end. The Fed expects growth in 2026 to be 2.3%, up from 1.7% in their September forecast. Expectations are now close to 3.0% growth for the 3rd quarter, which would strengthen the case for stronger corporate earnings and the potential for broadening equity market participation.

Equities

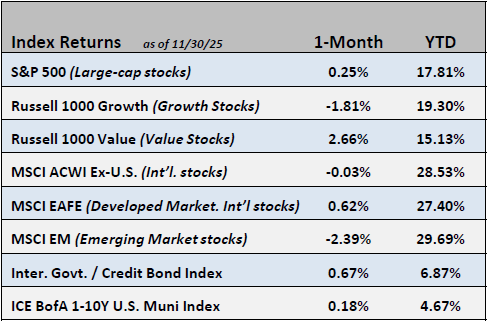

- In November, the S&P 500 returned +0.25%, the index’ smallest monthly gain over the past seven months. Both low-volatility and value stocks led as momentum and growth-oriented shares lagged. Sector leadership was provided by health care and communications services. International stocks performed in-line with domestic equities.

- The S&P 500’s forward P/E multiple moderated slightly during the month, closing at 22x. Estimates continue to support strong growth ahead in company earnings as consensus projections now call for +10% for this year and +13.2% next year.

Fixed Income

- Interest rates declined over the past month on average due to expectations that the Federal Open Market Committee (FOMC) would ease again at their December meeting.

- Investment grade credit widened 2 basis points while high yield tightened 5 basis points. Although credit spreads remain historically tight, all-in yields are still attractive.

Employment

- Since the April tariff announcements, small businesses have lost 264,000 jobs while large and mid businesses have continued hiring. This is disconcerting as nearly half of all workers are employed at small businesses.

- Unemployment in November rose to 4.6%, the highest level since 2021. Job growth, especially within small businesses, will be a concern for the Fed moving into 2026.

Federal Reserve

- The dispersion of views amongst the Fed Governors as to path of interest rates will be a source of concern for investors as the new year begins. Expectations for future rate cuts have declined from four cuts in 2026 to perhaps one cut.

- As Chairman Powell’s term expires in May, all eyes will be focused on whom the President nominates to be Chairman. Disparate views between the members of the Fed over inflation and the jobs market will not make the job easy.

Issues to Watch

- Inflation statistics have remained above the Fed’s target of 2%. The latest reading of the Core PCE was 2.8% and the expected CPI rate for November is 3%. The course of inflation will be a particular focus for investors in 2026.

- Much has been written about the growing rift between the U.S. and Europe on trade, economic and defense issues. The potential to further separate the U.S. from its largest trading partners is a risk that should not be understated.

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

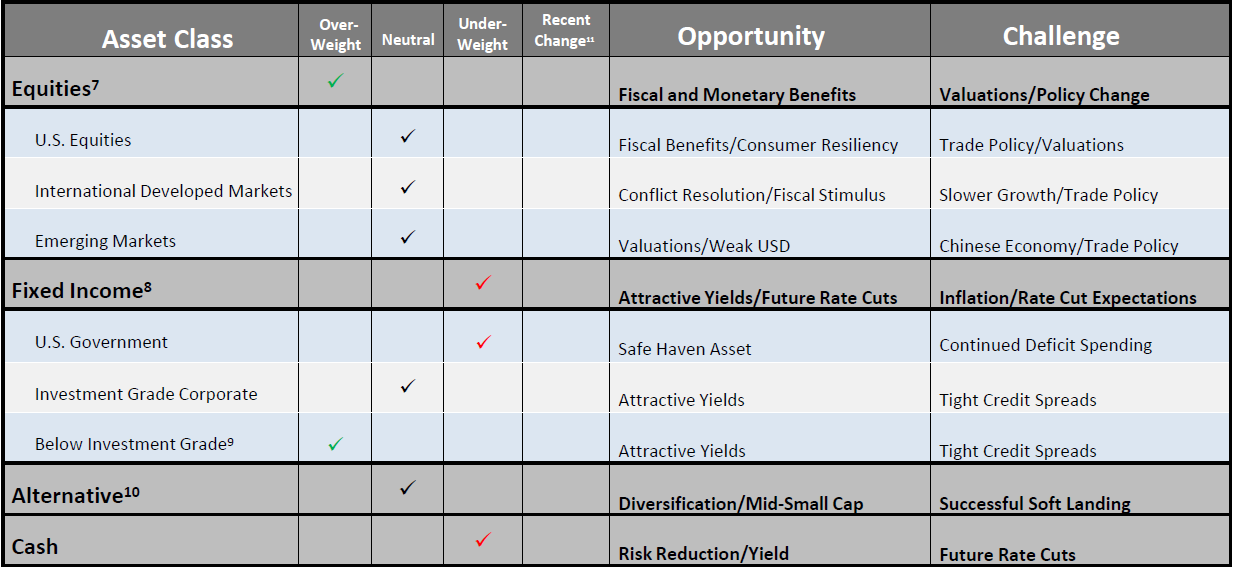

Asset Allocation / Tactical Positioning - December 2025

7Equity tactical weights are relative to the Cambridge Trust Wealth Management Core Equity allocation and is comprised of 80% S&P 500 and 20% MSCI AC World ex-U.S Index.

8Fixed Income tactical weights are relative to the Cambridge Trust Wealth Management Core Taxable allocation and is comprised of 100% Barclays Intermediate Gov/Credit Index.

9Below investment grade holdings include high yield and emerging market debt mutual funds. Represents an out-of-benchmark allocation that will be reflected as an overweight position relative to the Barclays Intermediate Gov/Credit Index if any allocation is held.

10Alternative tactical weights represent an out-of-benchmark allocation that will be reflected as an overweight position when utilized and neutral position when not.

11Direction arrow highlights any recent changes of the overall allocation after a recent tactical asset allocation or strategy change. Last changes were made at November 2025 Asset Allocation Committee meeting.

Views are as of December 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.