The fourth quarter started nervously but turned into a strong rally at the end of October and throughout November as economic data supported a “soft landing” narrative while markets also received Fed comments indicating that their hiking cycle is likely over and that there might even be room for rate cuts sooner than expected. Happily for client portfolios, the Q4 rally capped a surprisingly strong year for the market. The economy was solid and asset prices were remarkably resilient, although the bulk of performance was generated by the so-called Magnificent Seven1 stocks. By contrast, the rest of the market turned in a positive though less dramatic performance. On a forward basis, this dispersion in performance between headline names and the rest of the market served as a reasonable reset and the overall market continues to offer opportunities despite the run-up.

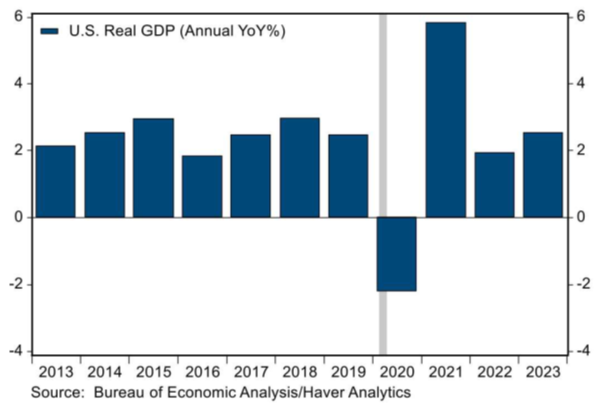

As we previously discussed, a universally hard or soft landing was not necessarily the only possible outcome—with a mixed, bumpy landing more likely. In some regards, 2023 was this bumpy, “rolling” recession where the market and the economy survived the turbulence of numerous Federal Reserve interest rate hikes, the banking crisis surrounding Silicon Valley Bank, labor strikes and related input cost challenges, the onset of multiple wars and an earnings recession that saw many companies and sectors already work through a trough. Through it all, inflation moderated, and gross domestic product (GDP) remained healthy at over 2% growth:

Source: Stifel, 1/26/2024

Source: Stifel, 1/26/2024

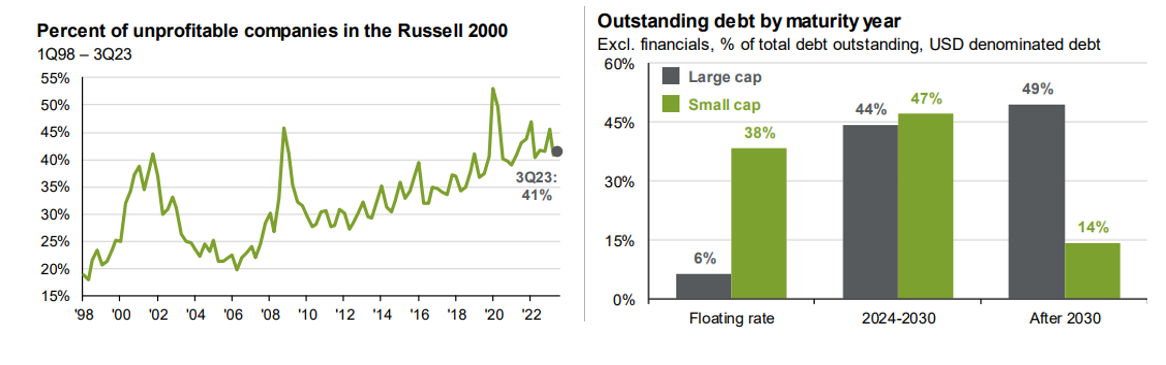

This summary is not to say that all challenges are behind us or that the economy (and inflation) have fully “landed”. The careful balancing remains an ongoing process. Ongoing issues include the conflicts in the Middle East and the Red Sea, contentious US budget negotiations, and volatility around the upcoming presidential election. Also, though contained up to this point, it is not clear that we have heard the last of commercial real estate stress. On a more subtle note, many members of the Russell 2000 small cap index are unprofitable and could face challenges operating in this higher interest rate environment. These are not stocks that we own to any great degree, but they will play role in the mood and outlook of the market overall. They are navigating well enough thus far.

Source: JP Morgan, Guide to the Markets, 1Q 2024

Our Asset Allocation Committee met last week and agreed to a baseline recommendation to move up to fully invested and neutral to prescribed weightings while staying balanced on a risk basis considering the wide range of possible outcomes in economic and geopolitical events. In the meantime, data remains solid, and our companies are well positioned. For most accounts, recent trading has been around rebalancing and adjusting position sizes, rather than any major changes. Directionally, we favor large cap over small cap equities given the late stage of the business cycle. We moved to overweight the US as compared to international equity exposures. We have a tilt toward attractive individual underlying positions rather than any overriding macro or factor exposure. We also have a small position in alternatives via a call writing position.

Within fixed income we have a small overweight to duration to lock in some longer-term higher rates as the prospect for rate cuts could be drawing nearer and short-term yields could shrink away. We are conservative with our credit positions in fixed income considering the tightness of current yield spreads, and like mortgage-backed securities as a diversifying high-quality position. We are moving cash positions into longer term bonds and other assets. We have no dedicated exposure to commodities currently.

Portfolios benefited from broad exposure in 2023, especially during Q4 when all asset types rallied strongly. However, the high current correlation between stocks and bonds (as shown below) unfortunately means there is less diversification or risk offset by bonds in relation to stocks, especially if the interest rate outlook is delayed or disappoints (such as would be the case if inflation perks back up). High quality holdings and some cash buffer help to manage this risk.

Source: Bloomberg, John Authers, “Points of Return”, 1/4/2024

In equities, the S&P 500 was up 11.7% for the fourth quarter with individual sectors performing in a range of -7.0% (energy) to +18.8% (real estate). All sectors, other than energy, were positive for the quarter. For the full year, sector performance ranged from -7.1% (utilities) to +57.8% (technology). The Q4 rally broadened out, but the story of the Magnificent Seven still dominated the year and largely carried the +26.3% performance for the S&P 500.

Many of the Magnificent Seven are high quality, fundamentally sound companies with low leverage that fit our long-term investment philosophy. These stocks are not immune to periodic volatility or temporarily stretched valuations, yet we do expect to own at least a portion of these leaders for the long haul given their dominant market share and outlook. To round out portfolios around this leadership, we continue to identify attractive opportunities in the “other 493” where valuations are favorable. Themes in our equity models continue to include generative artificial intelligence (AI), cyber security, cloud computing, automation/digitization and electrification/clean energy transition as well as select opportunities in healthcare and industrials.

Looking forward, market consensus is expecting approximately 12% earnings growth in 2024 for the S&P 500. That type of growth would be quite healthy if it comes to pass. However, the challenge is that prices already reflect very healthy profit margins, and any hiccups would be a disappointment to the market from these fully valued price levels. There are numerous earnings announcements coming this week which will further clarify outlook and market sentiment.

In international markets, Q4 performance was strong and only slightly lagged the US as the MSCI All Country World Index (ACWI) ex-US Index was up 9.8%. For the full year, there was wide dispersion across countries with Brazil up +33.4%, Japan +17.8% and China down -13.0%. These differences are a primary reason we advocate for active management and differentiation within international investments for most client portfolios. This approach led to outperformance in international versus benchmark for many portfolios.

Bond markets were up in Q4 as market consensus rejoiced that the data and Federal Reserve rhetoric seemed to corroborate that the rate hiking cycle was over. An additional boost came from consideration that rate cuts might be coming sooner and in greater size than previously priced in— (although the Cambridge Trust team thinks the market might be ahead of itself in terms of the number of rate cuts currently priced into futures’ markets). In many respects, the bond rally bailed out what was setting up to be a negative year for certain parts of the bond market. Intermediate bonds ended the year up 5% and generally in-line with the performance of cash and short-term assets. Higher risk portions of the bond market, especially those correlated with equities, generate double-digit performance (on an index basis: high yield +13.5%, leveraged loans +13.3%, emerging market debt +10.6%).

In credit markets, even with the less hawkish interest rate outlook, we are still actively monitoring the negative feedback loop of higher funding and debt service costs facing many governments, consumers, and corporations. Corporate debt once thought to be safely extended out to longer maturities will eventually come due for refinancing. At current levels, we have limited exposure in lower rated credit and are waiting for better risk/reward opportunities before adding more.

2023 was a great year for client portfolios, although such a rally means that a lot of good news was pulled forward and priced in. 2023’s strong rally will be a hard act for the markets to follow in 2024, and we have more modest expectations from these starting levels. We remain close to benchmarks with geopolitical and economic uncertainty running high, although we acknowledge the impressive resiliency of the US consumer and the economy thus far. Our model portfolios are mostly in quality US large cap stocks which we consider excellent long-term investments. These core holdings are not invincible, and will periodically retrace, but they do so from a strong balance sheet and are less dependent on capital markets for fundraising and can absorb periodic volatility. We complement these core holdings with global diversification as well as robust, high quality bond portfolios.

[1] The Magnificent Seven refers to Apple, Alphabet (Google), Amazon, Meta (Facebook), Microsoft, Nvidia, and Tesla.