Here’s a list of some of the key end-of-year situations that might apply to you. Use it as the starting point for conversations with your financial professionals.

In light of how financial markets have performed this year, you may be able to reduce your taxes by selling some investments at a loss to offset the taxable gains you’ll report on others, a strategy referred to as “tax-loss harvesting.”

Your investment professional can recommend which groups of securities (or “tax lots”) to sell based on their original purchase price, and potential long or short-term gains or losses. He or she also will be mindful of the “Wash Sale Rule” which disallows the loss if you sell a security and buy a similar security back within 30 days.

If you have excess losses, and the amount you hold of a single stock position has become too concentrated, this may be the time to sell that stock to trim back your over-exposure. Or you might consider donating the highly appreciated stock directly to one of the charities you support. If you do, and the stock has appreciated over time, you can take a deduction for its full market value and you won’t have to pay taxes on your gains. (Your deduction is limited to 30% of your AGI, with any excess deduction carried forward for 5 years).

If you’ve taken RMDs in previous tax years, your Relationship Manager can help you calculate the amount to withdraw from workplace plans (such as 401(k)s or 403(b)s) and Individual Retirement Accounts (IRAs) and SEP IRAs.

If you just turned age 70½ this year and are taking your first RMD, you have two options: You can take your distribution by the end of December or delay taking it until April 1, 2019. If you choose to wait, however, remember that you will then have two RMDs to pay taxes on next year (both your 2018 and your 2019 amounts), which could increase your taxable income and may push you to higher income tax bracket.

You’ll also want to be very sure you include all of the retirement accounts you’ve held at previous employers because the penalty for not taking a required distribution is substantial: 50% of the amount not withdrawn.

On the other hand, if you don’t need the income, you can still satisfy some (or all) of the minimum distribution requirements for an IRA--and avoid paying taxes on the withdrawal--by donating that RMD directly to a charity instead. This donation, called a qualified charitable distribution (QCD), is only available for IRA accounts, so you must rollover your 401(k) or other workplace plan assets into IRAs before you can donate them. Your tax advisor can help you with the forms you’ll need to report the RMD donation as a QCD. The maximum you can donate is $100,000 each year.

Finally, while you’re looking at your retirement accounts, this is a good time to confirm that the beneficiaries you have listed on them are up to date.

The individual contribution limit for workplace 401(k) and 403(b) retirement plans is $18,500 or $24,500 (an extra $6,000) if you are age 50 or older. If you haven’t met that limit, now is the time to check with your company benefits department to see if you can contribute more before year end to reduce your taxable income while you save more for the future on a tax-deferred basis. If it’s too late to make the change this year, make sure you adjust your paycheck deduction for the year ahead.

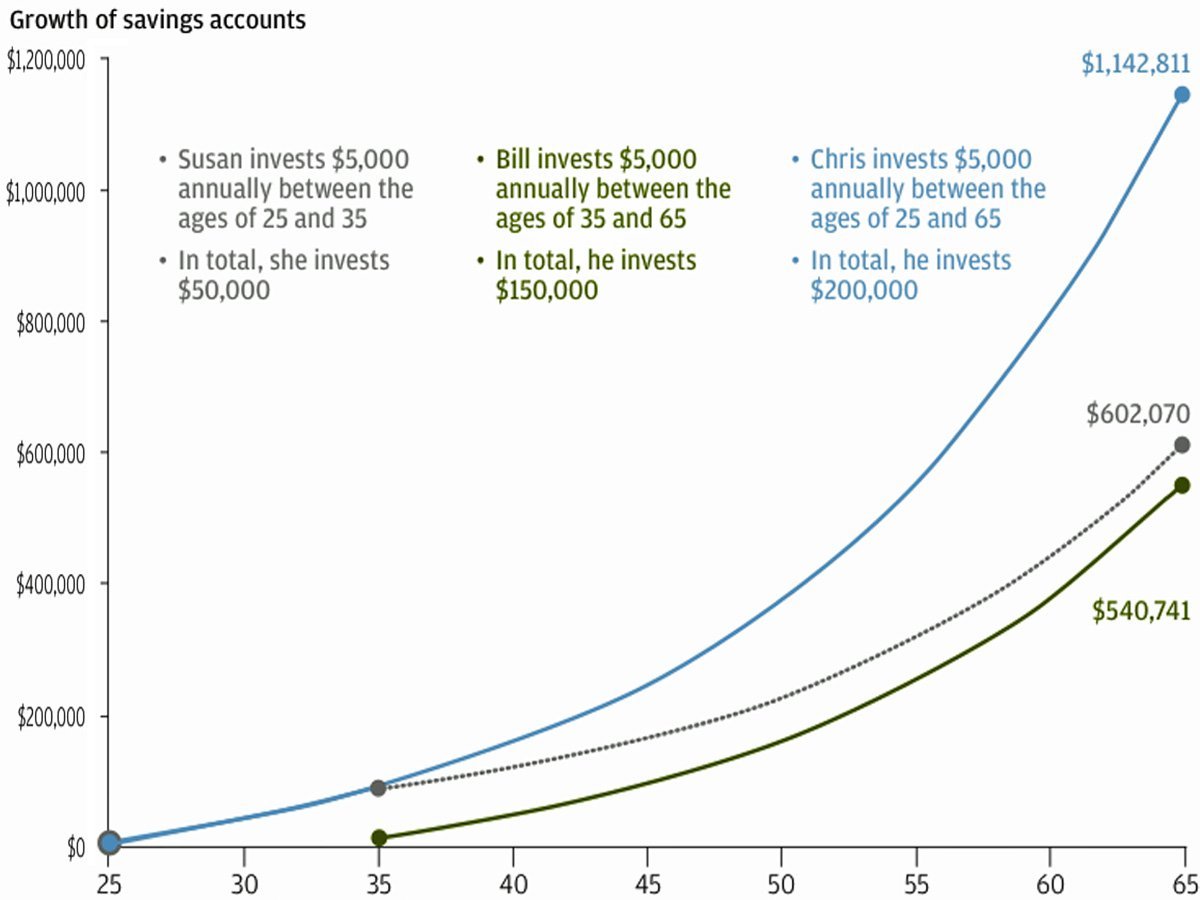

If you’re eligible to contribute to a tax-deductible IRA, SEP-IRA, or SIMPLE IRA, consider making your contribution before year-end rather than waiting until the April, 2019 deadline. That will give you four more months of possible tax-deferred growth through compound interest. And the potential to grow your savings through compounding is even greater for those who start early, as the chart below illustrates.

If your income level means you’re not eligible to contribute directly to an after-tax Roth IRA, you can still take advantage of a Roth’s future tax-free distributions and lifetime growth potential with an IRA to Roth conversion. When you do this, you’ll need to pay taxes on the converted amount because no taxes were deducted from the IRA previously.

At the same time, you don’t want the extra income from the conversion to push you into a higher tax bracket. That’s why an IRA to Roth conversion is a good option for a year when your income drops significantly from the year before. So if you were changing jobs or building a new business in 2018 and your annual income will be lower than in previous years, this could be the right time to convert some of your pre-tax IRA retirement money into a post-tax Roth IRA.

Once you do:

-- All future growth and distributions for the Roth IRA will be tax-free (as long as the Roth has been in existence for five years and you have reached age 59 ½).

-- Your Roth has the potential to grow after you reach age 70 ½ because no RMD will be required.

Make sure you check in with your tax professional to confirm that you have other sources of funds to pay the taxes on the conversion and that you’re comfortable with making the change. With the new tax rules, once you convert to a Roth IRA, you can no longer change your mind and “recharacterize” back to a Traditional IRA.

This can protect you from future interest rate increases.

This can help you take advantage of any state or local income tax savings in your new location. The steps you must take to qualify for residency vary from state to state, but typically require that you register to vote, establish your primary doctor, and get your driver’s license at your new address. Once you meet those requirements, your taxes will be prorated between your current state and your previous state based on how long you were a resident in each one.

Under the new tax law, interest paid on HELOC funds used for “capital improvements” to your home are still tax-deductible subject to the new $750,000 loan value cap for your primary mortgage and your line of credit combined.

But remember, that mortgage cap only applies if you choose to itemize deductions on your 2018 tax returns rather than take the new standard deduction of $12,000 ($24,000 per couple). If you itemize, the maximum amount of mortgage interest you can deduct from 2018 taxes is now capped at the interest paid on up to $750,000 of your loan’s value (for new mortgages entered after 12/15/2017).

With the new tax law, this only applies if you itemize deductions on your 2018 tax return. And the deduction for long-term appreciated securities is still limited to 30% of AGI.

If you need more time to determine how much to donate to different charities before the December 31 tax deadline, consider contributing to a Donor-Advised Fund (DAF) instead. Once you set up your DAF account, you can make a single large contribution to it each year to take advantage of the charitable giving deduction for that year. Then you can make the decisions about which individual charities you want to support from the fund in a more leisurely manner over the next few months.

If you’ll be making gifts to children or grandchildren for their future well-being, remember:

Some companies extend the deadline to use an FSA beyond the end of the year, others will rollover up to $500 to the next year, so it’s best to check this first. But if you need to spend down your FSA balance before a certain date, consider buying new glasses or over the counter medications with the extra cash.

For a list of what items are eligible and not eligible for FSA spending (and which ones may require a prescription first) visit the FSA store.

Of course, the sooner you take care of these end-of-year details, the better, because: