Many of our individual and trust clients are in the highest federal income tax bracket (37%), pay state income taxes (5.1% in Massachusetts, for example), incur capital gains taxes up to 20% and pay the net investment income tax (NIIT) at 3.8%. Implementing tax sensitive investment strategies for these clients is a critical and impactful part of the investment process. However, even clients in lower tax brackets can achieve tax savings through a tax-aware investment approach.

Below we discuss the sources of portfolio taxation: bond income, stock dividends and capital gains.

Bond Income Taxation

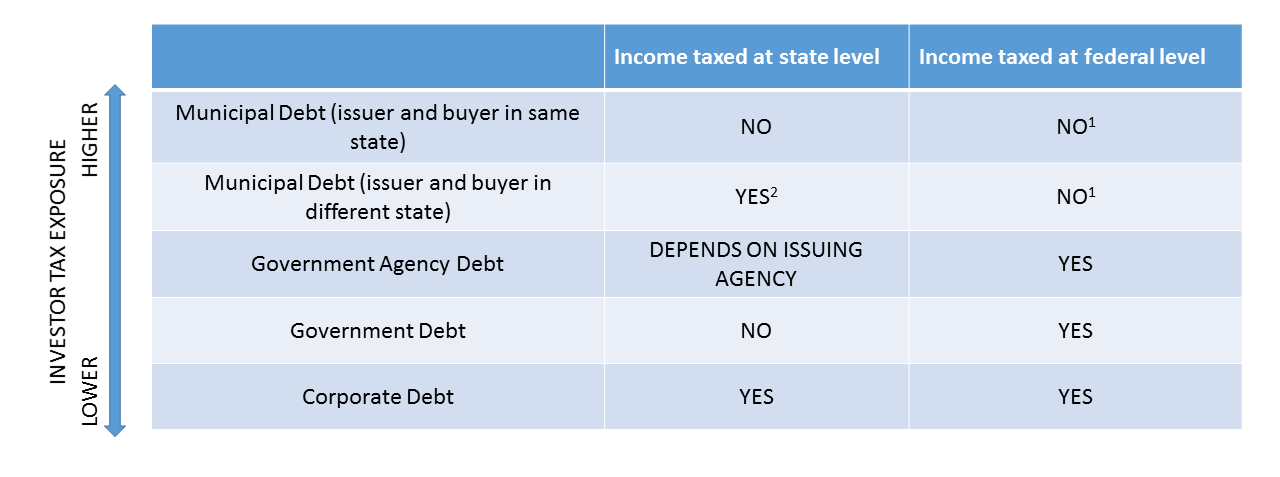

Federal, state and local governments levy taxes on income produced by bonds and other fixed income securities. The tax rate depends on the issuer of the fixed income security and the individual buyer’s tax rate. Income on bonds issued by the Federal government and some Federal agencies is not taxable at the state level. Corporate bonds and some agency bonds are taxable at the state level and all of these bond types are taxed at the federal level. Most municipal bonds issued by local governments and states are not taxable to individuals living in those respective states. Income from municipal bonds purchased by an individual living outside of the issuing state still avoids federal tax but does incur state tax.

There are generally two types of dividends paid to investors: ordinary and qualified dividends. Ordinary dividend income, as the name suggests, is taxed at the typically less favorable ordinary income tax rate. In other words, because this type of dividend income is treated as ordinary, standard marginal tax rates up to 37% apply. Qualified dividend income is taxed at the usually more favorable long-term capital gains rate. Most publically traded U.S. stocks and many foreign stocks are able to satisfy the IRS’s requirement for qualified dividend status assuming a holding period of greater than one year.3

Stock Dividend Taxation

However, an additional complication with the dividends of foreign companies is the threat of double taxation. Some countries withhold taxes on dividends reducing the payment received by U.S. based shareholders. These dividend payments are taxed again by the U.S. government. The IRS addresses this issue by allowing a foreign tax credit or deduction to offset the withholdings of foreign countries.4

Capital Gains Taxation

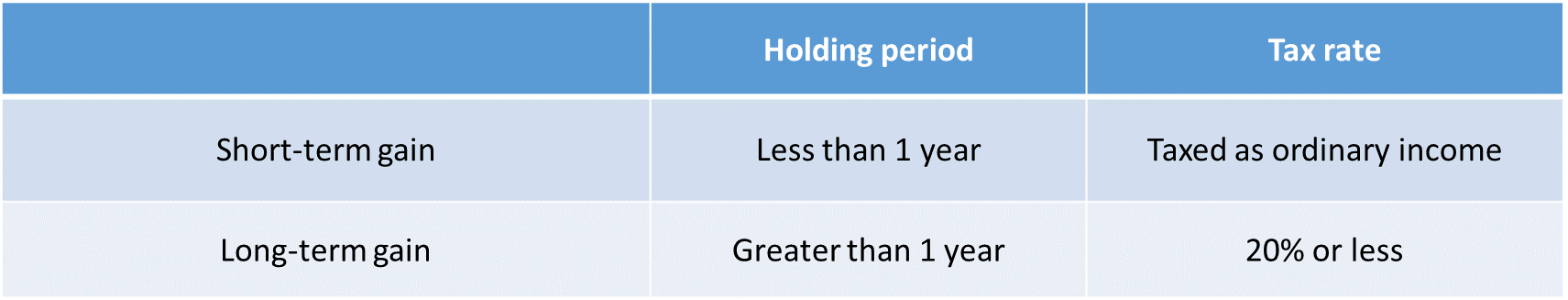

When a stock appreciates in value this creates an unrealized capital gain. When the stock is sold, the gain transitions from unrealized to realized. For any realized capital gain, the taxpayer will pay a capital gains tax. The maximum tax on any asset sold that is held for longer than a year (long-term gain) is 20%. A married couple with reported annual income of greater than $488,850 in 2019 will hit this rate. Below $488,851 but above $78,750, the rate is 15%. For assets sold that are held for less than a year, the higher ordinary income tax rate based on marginal tax brackets applies. As a result, we endeavor to limit short-term gains whenever possible, as these gains carry the largest tax burden.

Aside from the obvious desire to limit a client’s tax burden, there is a second and less understood reason for limiting realized capital gains. Realized capital gains are factored into your adjusted gross income (AGI). The addition of significant capital gains to AGI can cause phase-outs of personal exemptions, itemized deductions, certain tax credits and access to beneficial retirement vehicles like Roth IRAs.

Now that we have covered the sources of taxation, let us move on to discuss the three primary strategies employed for managing taxable gains.

The main approach is tax loss harvesting. While nobody enjoys losses, they do occur from time to time in diversified portfolios. However, tax loss harvesting (selling securities at a loss) provides a helpful silver lining. Realized losses are a valuable tax asset for several reasons: they can be used to offset taxable gains; tax payers can deduct up to $3,000 a year against ordinary income if losses are greater than gains; and losses can also be carried over to future years.5

Gifting highly appreciated stock to family or charities is also a common way to avoid gains. Gifting stock to children is beneficial when the child has an AGI that qualifies them for a lower tax rate on capital gains (0% or 15% versus 20% for the parent).6 As a result, any sale will incur a lower capital gains tax for the gift recipient. A gift of stock held for longer than a year to a charity qualifies for a tax-deduction equal to the stock’s fair market value. Taxpayers can deduct up to 30% of their AGI via charitable stock deduction. Not sure of what charities to which you would like to make a contribution? No problem. Through Donor Advised Funds (DAF), one can get an immediate deduction and determine recipients at a later date.

As discussed above, municipal bonds generate low tax or tax-free income for investors. For clients in higher tax brackets, municipal bonds typically offer better after tax returns than corporate, government or agency debt. If taxes are not a factor, these latter bond types make the most sense for low tax exposure accounts like individual retirement accounts and the accounts of institutions that are tax exempt.

There are other factors to consider when thinking about tax exposure:

how often portfolios are rebalanced

the use of mutual funds versus individual securities

stock positions with large unrealized gains

the use of trusts

location/regime investing which considers the tax sensitivity of each security and the tax sensitivity of the security’s investment vehicle.

These factors are beyond the scope of this article and will be discussed in the follow up article.

At the end of the day (usually that day is April 15th!) taxes matter. At Cambridge Trust, we employ typical techniques such as tax loss harvesting, investments in municipal bonds and gifting to minimize our client’s tax burden and, where appropriate, implement strategies that are more sophisticated. We are happy to talk to you and your accountant to see which approaches are best for you.