We continue with a cautious stance and are underweight in equities, neutral (market weight) in fixed income and overweight to cash as dry powder for new opportunities while earning relatively attractive short-term yields in the interim.

Economic conditions will likely continue to soften. The banking sector is still under pressure from the inverted yield curve. Even if more major issues are avoided, lending standards are being tightened and there is just no longer as much funding to go around, at least not at favorable rates or covenant-lite terms. This pulling back will have a dampening effect and put stress on marginal or overleveraged players. The potential stress in Commercial real estate will also create a deflationary impulse and further negative ripple effects. While markets often look forward opportunistically and carry on without undue worry about economics, there is always the need for an eventual reckoning and recalibration back to what economic activity means for earnings and profitability in stocks as well as creditworthiness in bonds.

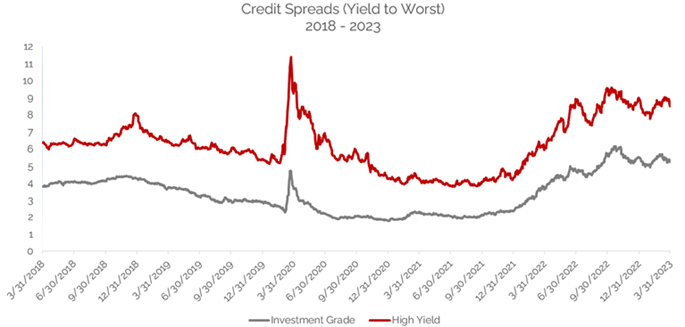

As shown below, credit spreads are wider since early 2022 but have been relatively resilient in 2023 considering the challenging economic outlook, banking sector turmoil and related negative headlines. We would expect to see further separation between the riskier high yield segment (red line) and the more credit-worthy investment grade segment (gray line) in the months ahead.

We are confident for the long-term, but in the short-term remain cautious and patient. Portfolios have moderate cash buffers in place and room to dial up exposures as opportunities arise. The consumer, the labor market, retail sales and manufacturing are starting to show cracks. The stock market will look forward and across to the other side of the storm, but we are not convinced we are yet far enough into the storm to start adding more risk exposure. However, we do balance our view by acknowledging that in some respects this is the “most anticipated recession of all-time” and therefore some portion of bad news is already reflected in prices after last year’s sell off.