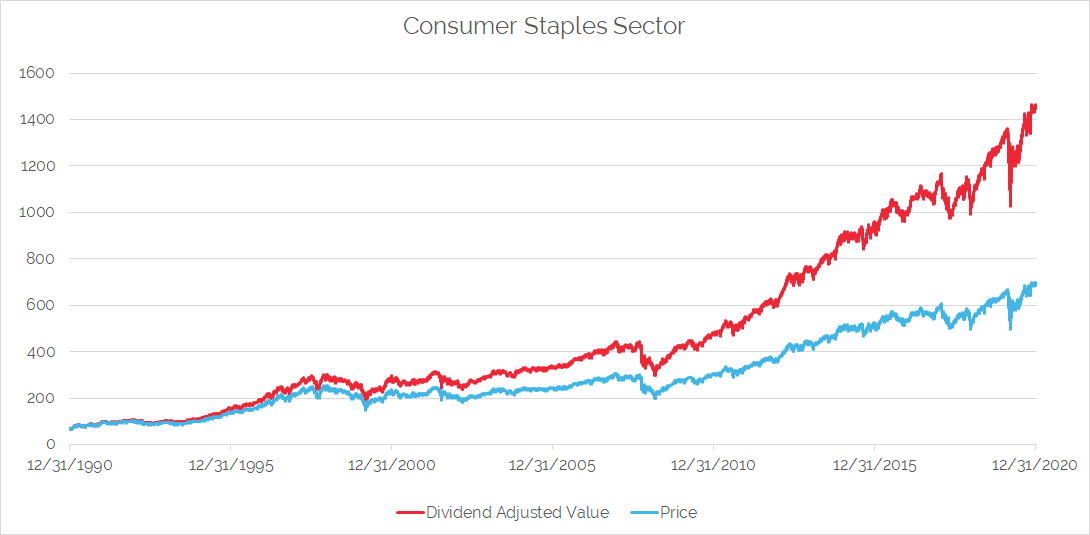

Source: Bloomberg

The sector makes up ~7% of the S&P 500 Index and is mainly comprised of large, well-established, slow-growing companies. In a world of doubling technology returns, a piping hot IPO market, and seemingly unlimited monetary stimulus, this strikes as a tad underwhelming. So why talk about it?