Key Takeaways:

- Start planning for wealth preservation a decade in advance of retirement

- Use a holistic planning approach based on your values and goals

- View tax efficiency from a lifetime perspective

- Prioritize the preparation of estate planning documents

- Consolidate wealth management and banking relationships to reduce complexity and potentially enhance financial outcomes

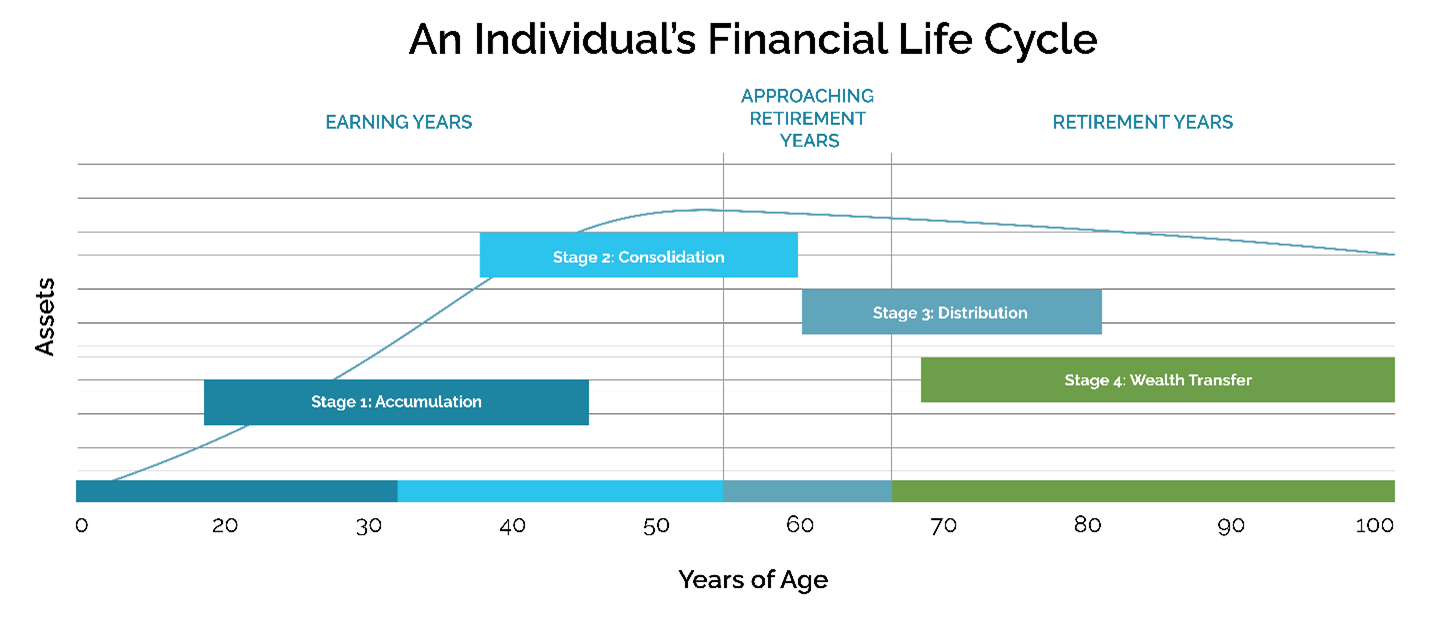

After working diligently to accumulate assets and achieve financial success, it becomes time to preserve and protect wealth. Those who have spent decades in the pursuit of asset growth will find goals naturally shift to safeguarding and distributing assets as retirement approaches.

In this article, we cover several insights that Cambridge Trust Wealth Management, a Division of Eastern Bank, has gained from working with high-net-worth individuals who have made this shift in a timely way and successfully maintained financial security for themselves and their heirs.

In this article, I share key insights Cambridge Trust Wealth Management, a division of Eastern Bank, has gained through guiding high-net-worth individuals who have proactively navigated this transition and preserved lasting financial security for themselves and future generations.

Start Planning Early

One of the biggest risks for high-net-worth individuals is not leaving enough time to plan. Ideally, individuals should begin thinking about wealth preservation well in advance of retirement. This allows for careful planning, including assessing income needs, consolidating accounts, and stress-testing financial plans against potential risks such as market volatility and unexpected expenses.

Given medical advances and increasing longevity, it is wise to plan for 30 or more years of retirement. Planning early can provide a longer runway to retirement, allowing you to successfully sustain three decades of retirement while fulfilling wealth transfer and philanthropic goals.

Early planning is beneficial for another reason: It allows sufficient time for the strategic use of Roth conversions.

Business owners should aim for roughly a decade of succession planning to assess the most effective business transfer strategies. Given sufficient time, business owners can work toward increasing the value of the business in anticipation of a future sale.

Why Holistic Financial Planning?

Holistic planning is the cornerstone of wealth preservation. It involves reviewing personal and financial goals, analyzing current and projected assets, and determining how best to manage wealth to achieve those goals. It generally includes a cash flow analysis to determine how much retirement income will be needed along with from what sources and in what order to draw.

It's essential to assess the strength of a financial plan prior to implementation. Cambridge Trust Wealth Management believes in using stress tests for this assessment. Stress tests reveal how robust a plan will be if unexpected events occur, such as a long-term care event, a job loss, or a market downturn. This analysis provides an opportunity to adjust the plan to optimize outcomes, yet another reason to start planning early.

Establish a Solid Estate Plan

It is also important for high-net-worth individuals to build a solid estate plan. When the plan is well-structured, wealth can be passed on efficiently and estate tax liabilities can be minimized.

Estate planning can incorporate sophisticated legal and financial strategies and begins with the preparation of basic, yet essential, legal documents. A will, power of attorney, healthcare proxy, and possibly a trust should be put in place as soon as possible. Should the unexpected happen, these documents can ensure wealth will be distributed according to your wishes and in a tax-advantaged way. There is peace of mind in empowering others to make decisions if you become medically or mentally unfit to do so.

Be sure to consider strategies that could reduce the size of your taxable estate, such as the annual gift tax exclusion, the lifetime gift tax exemption, and an irrevocable life insurance trust. Other estate planning strategies enable you to protect assets from creditors and liabilities. Examples include buying an umbrella or liability insurance policy, setting up an asset protection trust, or creating a separate business entity.

Minimize Taxes to Preserve More Wealth

Typically, people think in terms of strategies that will lower annual tax bills; however, it is just as important to consider minimizing lifetime tax obligations.

Some individuals have a high percentage of wealth in tax-deferred accounts which might not be the best practice when the time comes to take distributions because every withdrawal could be fully taxable.

Roth Conversions to the Rescue

Roth conversions are a popular way to move some tax-deferred assets in IRA or 401(k) accounts to Roth accounts. After five years, the account becomes a source of tax-free retirement income or can be left to grow for beneficiaries and pass onto them tax-free.

Why Asset Location Matters

Thinking about “asset location” can help minimize taxes on investment growth, interest, and dividends and maximize after-tax returns. This strategy capitalizes on differences in the tax treatment of investments. It calls for holding tax-inefficient investments in tax-deferred accounts and putting tax-efficient investments in taxable accounts.

Consider Tax-Loss Harvesting

Tax-loss harvesting is another beneficial strategy to convert market losses into tax savings. When used properly, it helps to mitigate annual income taxes without impacting long-term investment outcomes.

Maintain a Balanced Investment Strategy That Makes Room for Growth

While shifting from a growth-oriented to a lower risk portfolio, we favor a balanced strategy that includes a mix of stocks, bonds, and other asset classes. Beware of investing too conservatively, however. Some growth is necessary to maintain financial security during a retirement that could last 30 years or more. Your rate of return should exceed the rate of inflation if you intend to sustain your lifestyle.

Diversification is key. Be careful not to concentrate too many assets in a single asset class, whether it be equities or real estate. Stock options, for example, may lead to a portfolio being overweight in equities. Heavy exposure to that single security can be financially devastating if its value drops. In our experience, it is not uncommon for individuals to have significant amounts invested in a single stock. This level of concentration demands immediate attention.

Make Money Matters a Subject for Family Discussion

Start now to equip future generations with the knowledge to preserve and grow their inheritance. Holding regular family meetings can be a good opportunity for productive conversations and educational discussions that can help younger family members become better stewards of wealth.

Consider sharing relevant information about your financial situation and estate plan. Use your judgment about what the family needs to know and when they should know it. You may be reluctant to reveal the extent of your wealth, but withholding too much information can become problematic.

Remember that younger generations might be interested in financial strategies and instruments with which you aren’t well acquainted. Their approach to wealth management may differ from yours, yet it may be appropriate for their stage in life and today’s changing financial environment. It pays to be open-minded and to suggest they seek professional advice. Your relationship manager – or one of your manager’s associates – may be a great fit for their needs.

Pair Wealth Management and Private Banking Services

Private Banking services will help you implement wealth management strategies by providing preferential interest rates on deposit accounts and customized personal and business lending solutions. For example, you can borrow against your investment portfolio at competitive rates, find flexible terms on a jumbo mortgage, or open a high-yield deposit account to meet cash management and liquidity needs. The Wealth Management team partners with our Private Banking team to bring clients a stewarded experience, anticipating their personal and professional needs. And, for business owners, our Eastern Bank Commercial Banking colleagues are also available to assist.

Consolidating wealth and banking relationships with one institution offers a unified approach to financial management, greater simplicity, and potentially better outcomes.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of May 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment Products are not insured by the FDIC or any federal government agency, not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC. Residential lending is provided by Eastern Bank, an Equal Housing Lender.