A United Nations report in 1987 defined a sustainable business as any organization that “meets the needs of the present world without compromising the ability of future generations to meet their own needs.”[1]

A sustainable business is one that strives to meet the triple bottom line of people, planet, and profit.

Today, sustainability plays a vital role in sound corporate strategy. Enterprises that engage customers, employees, community members, and investors on issues that matter the most to them foster loyalty, commitment, and productivity. They view sustainability as a long-term commitment, with current actions having far-reaching implications for future generations.

As a result, sustainability has increasingly become not just a solution for the morally conscientious, but also for the financially responsible. A company that proactively addresses issues today can protect itself from future problems and lay the groundwork for long-term success for the firm and its stakeholders.

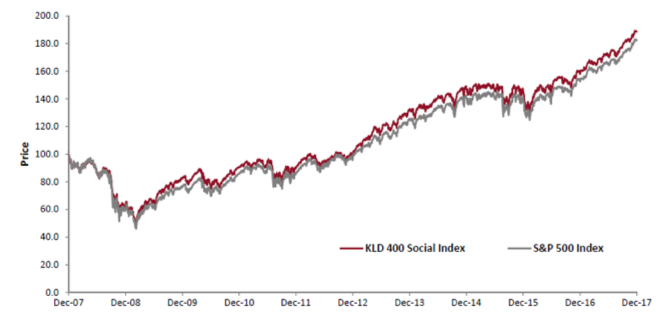

From a portfolio management perspective, companies with strong sustainability attributes perform well in comparison to their peers. The oldest index of sustainable investments, the MSCI KLD 400, has outperformed the S&P 500 since it was first introduced in 1990.

Chart 1

[1] United Nations General Assembly (1987) Report of the World Commission on Environment and Development: Our Common Future.

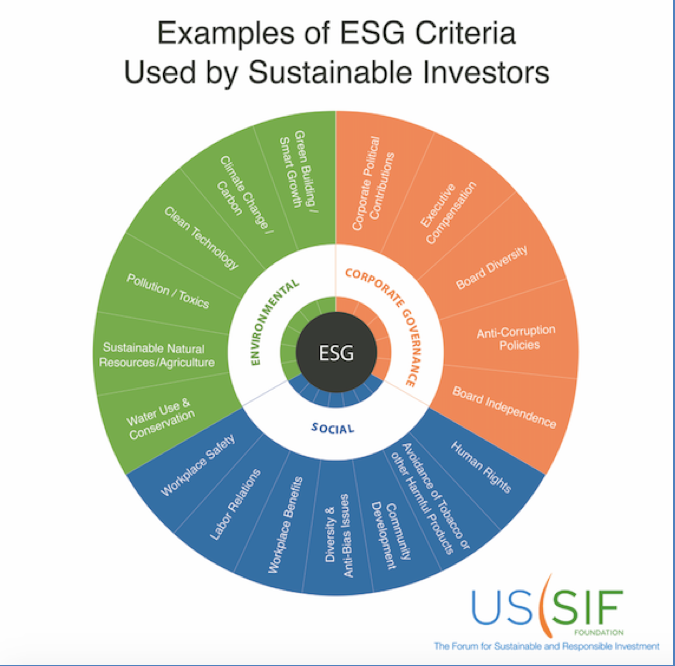

Recognizing the desire of their clients to invest in a more sustainable future for the next generation while investing toward their financial goals, investment firms have increasingly adopted an investment discipline known today as Sustainable and Responsible Investing (SRI).[1] At Cambridge Trust, we view SRI as an investment discipline that considers environmental, social, and corporate governance (ESG) criteria to generate long‐term competitive financial returns and positive contributions to society.

Investment managers typically consider a number of ESG criteria when evaluating and selecting companies based on their sustainability. Examples of these criteria are shown in the diagram below:

Chart 2

As interest in investing using ESG criteria has grown over the past two decades, SRI has evolved from a niche interest to a key consideration for portfolio management. For example:

In the following decades, environmental concerns, labor practices, and weak corporate governance practices have been challenged by investors. Climate change, the use of renewable energy, and “fracking” practices in the energy industry have been of particular focus.

[1] https://www.ussif.org/sribasics

Today, ESG factors have become important metrics for use in constructing Sustainable and Responsible Investment portfolios. [LINK to Part II] Portfolio managers and investment analysts scrutinize issues such as CO2 reduction, corporate community impact, and executive pay alongside more traditional investment research criteria to understand the full impact of the company and determine its long-term outlook. As individual investors increasingly see the influential role that businesses play in preserving our planet, they also seek to invest in companies exhibiting positive sustainability characteristics.

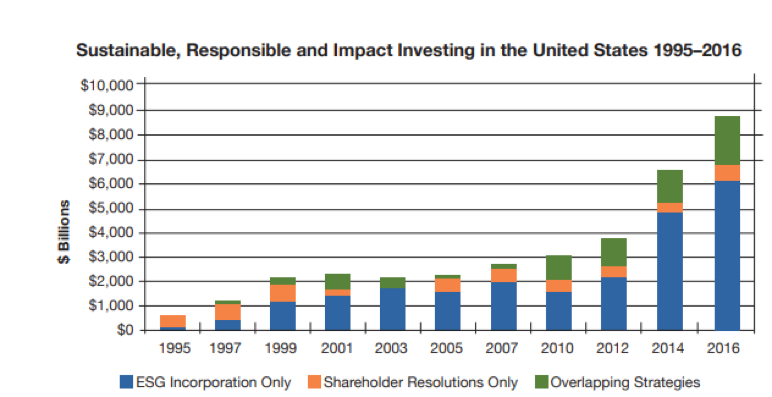

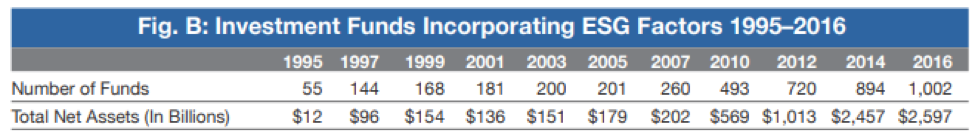

SRI is growing at a rapid pace as shown in Chart 2. According to The Forum for Sustainable and Responsible Investing (US SIF): [1]

Chart 3

Chart 4

This significant growth has been fueled by:

As SRI continues to become more understood, investors will be able to make more informed and effective decisions about investing in a meaningful, sustainable and responsible manner.

This article is for informational purposes only and should not be construed as investment or legal advice.

[1] Principles for Responsible Investment, http:///www.unpri.org