Economy & Markets

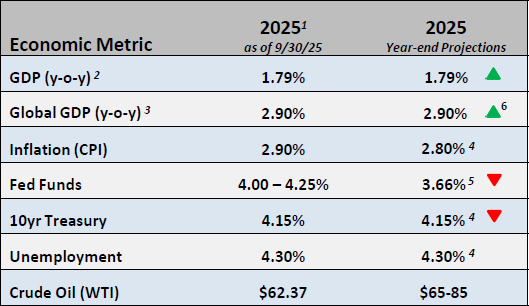

- The U.S. economy appears to be gaining strength even as employment growth slows. Economists now expect fourth quarter GDP growth of 1.7%, up from a 1.0% estimate in July. Next year’s growth forecast currently stands at 1.9%, which is still strong given the headwinds of an unsettled tariff environment and geopolitical issues in Europe and Asia.

- GDP growth for the second quarter was revised higher to 3.8%, up from an original estimate of 3.0%. Real final sales to domestic purchasers, our preferred measure of economic growth, was 1.4% in the first quarter and 2.4% in the second, resulting in a first half growth rate of 1.9%. Underlying demand has remained resilient despite the economic turmoil this year.

Equities

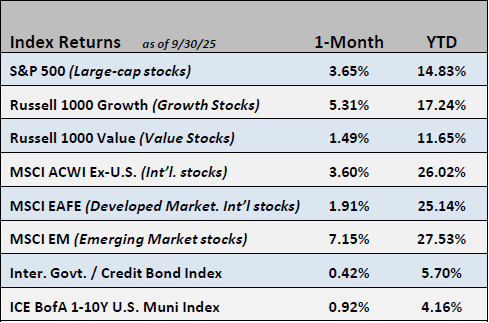

- In September, the S&P 500 continued to rise, adding 3.65% for the month. The market’s strength was driven by growth stocks, specifically large cap technology and communication services sectors, bringing the year-to-date return of the index to +14.83%. Domestic and International stocks provided similar returns (+3.5% and +3.6%, respectively) over the month.

- The S&P 500 forward P/E multiple continued to expand and reached 22.7x at the close of the month. Profit growth expectations remain strong with consensus estimates calling for a +9.6% increase in 2025 and roughly +13% for both 2026 and 2027.

Fixed Income

- The FOMC delivered the much anticipated 25-basis point rate cut at their September meeting. The Fed is divided on the extent of easing going forward as the median dot plot moved from 3 to 2 rates cuts for the balance of 2025.

- Credit spreads continued to tighten on positive technicals and fundamentals. While spreads remain historically tight, all-in yields are still attractive.

Employment

- The government shutdown has delayed the September employment report, but we do have data from ADP that affirmed the slow employment picture we have seen over the last several months. ADP reported a loss of 32,000 private sector jobs in September, the largest decline in over 2 years.

- We are essentially in a “Slow Hiring, Slow Firing” employment environment which has been exacerbated by tariff concerns, the expanding use of technology (A.I.) and the dramatic decline in immigration.

Federal Reserve

- The September Fed meeting, which resulted in a 25-basis point cut, demonstrates that the Fed is prioritizing the labor markets as it sets policy.

- Complicating the job of the Fed is stubbornly elevated inflation. The Fed’s preferred gauge of inflation remains at 2.9%, above their 2.0% target. If the Fed is successful in recharging the employment market, we could see higher wages which could make the fight to bring down inflation more difficult.

Issues to Watch

- Trade negotiations with China over rare earth materials are the latest complication faced by negotiators. Additionally, the Supreme Court will weigh in on whether the tariffs imposed by President Trump are lawful.

- Political unrest in Europe and Japan make any meaningful trade negotiations that much more difficult to achieve. A resolution to the fighting in the middle east may lead to a lowering of tensions in a very volatile area of the world.

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

Asset Allocation / Tactical Positioning - October 2025

7Equity tactical weights are relative to the Cambridge Trust Wealth Management Core Equity allocation and is comprised of 80% S&P 500 and 20% MSCI AC World ex-U.S Index.

8Fixed Income tactical weights are relative to the Cambridge Trust Wealth Management Core Taxable allocation and is comprised of 100% Barclays Intermediate Gov/Credit Index.

9Below investment grade holdings include high yield and emerging market debt mutual funds. Represents an out-of-benchmark allocation that will be reflected as an overweight position relative to the Barclays Intermediate Gov/Credit Index if any allocation is held.

10Alternative tactical weights represent an out-of-benchmark allocation that will be reflected as an overweight position when utilized and neutral position when not.

11Direction arrow highlights any recent changes of the overall allocation after a recent tactical asset allocation or strategy change. Last changes were made at September 2025 Asset Allocation Committee meeting.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of October 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Eastern Bankshares, Inc. © 2025 Cambridge Trust. All Rights Reserved. Cambridge Trust is a division of Eastern Bank.

Investment advisory services and investment products are not insured by the FDIC or any federal government agency, not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC.