Economy & Markets

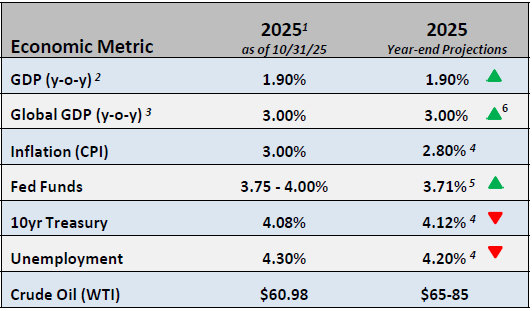

- The economic impact of the government shutdown has yet to be determined but will likely have a negative effect on fourth quarter growth. However, continued spending by high income households along with robust capital expenditures on AI infrastructure should offset this temporary weakness and remain as the key growth catalysts for the remainder of 2025.

- Tariff levels continue to fall from their peak on “Liberation Day” due to negotiated trade agreements and exemptions. Businesses are absorbing some of the higher costs thereby limiting price increases to consumers. However, inflation remains elevated with low and middle-income households struggling to keep up with the rising costs of living.

Equities

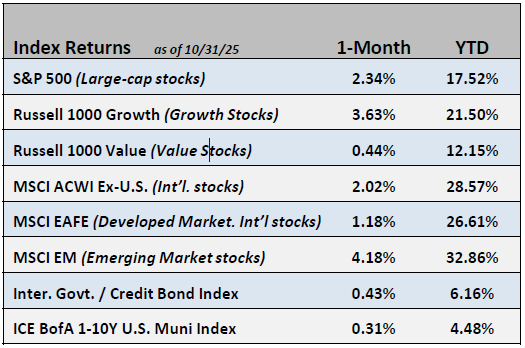

- In October, the S&P 500 advanced by 2.34%, continuing its upward trend. Growth stocks maintained leadership across market capitalizations, particularly within the large-cap technology sector, bringing the index’s year-to-date return to +17.5%. International equities also delivered positive results, gaining 2.02% for the month, slightly lagging domestic markets.

- The S&P 500 forward P/E multiple continued to expand, closing the month at 23x. Consensus estimates point to strong corporate profit growth ahead, with projections of +10% for 2025 and approximately +13.7% for both 2026 and 2027.

Fixed Income

- The FOMC delivered another 25-basis point rate cut at their October meeting. Chairman Powell indicated that another rate cut in December is far from certain.

- Credit underperformed as spreads moved wider. Investment grade increased by 5-basis points and high yield by 9-basis points. While credit spreads remain historically tight, all-in yields are still attractive.

Employment

- The latest ADP report reaffirmed a slowly growing labor market. However, small businesses, which employ nearly half of all U.S. private sector workers, have lost 130,000 workers this year.

- Layoff announcements by firms such as Amazon, the nation’s second largest private employer, and Microsoft have surprised employees as planned increases in productivity through investments in technology have threatened many white-collar jobs.

Federal Reserve

- As expected, the Fed cut rates by 25-basis points at their October meeting. When Chairman Powell delivered his post meeting comments, he said the chance of another cut in December was “not a foregone conclusion, far from it”, thereby deflating investor hopes and causing a sell off in markets.

- Growing weakness in the labor market is the primary concern of the Fed right now. Complicating the job of the Fed is stubbornly elevated inflation. The latest reading on inflation showed a still high 3.0% Core CPI level.

Issues to Watch

- The Supreme Court is deliberating over the legality of President Trump’s Tariffs. If the court rules against the tariffs it is widely expected that the Trump administration will seek alternative methods to implement its trade agenda.

- The November election results sent a strong message to Republicans that their slim majorities in the House and Senate could be at risk next year.

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

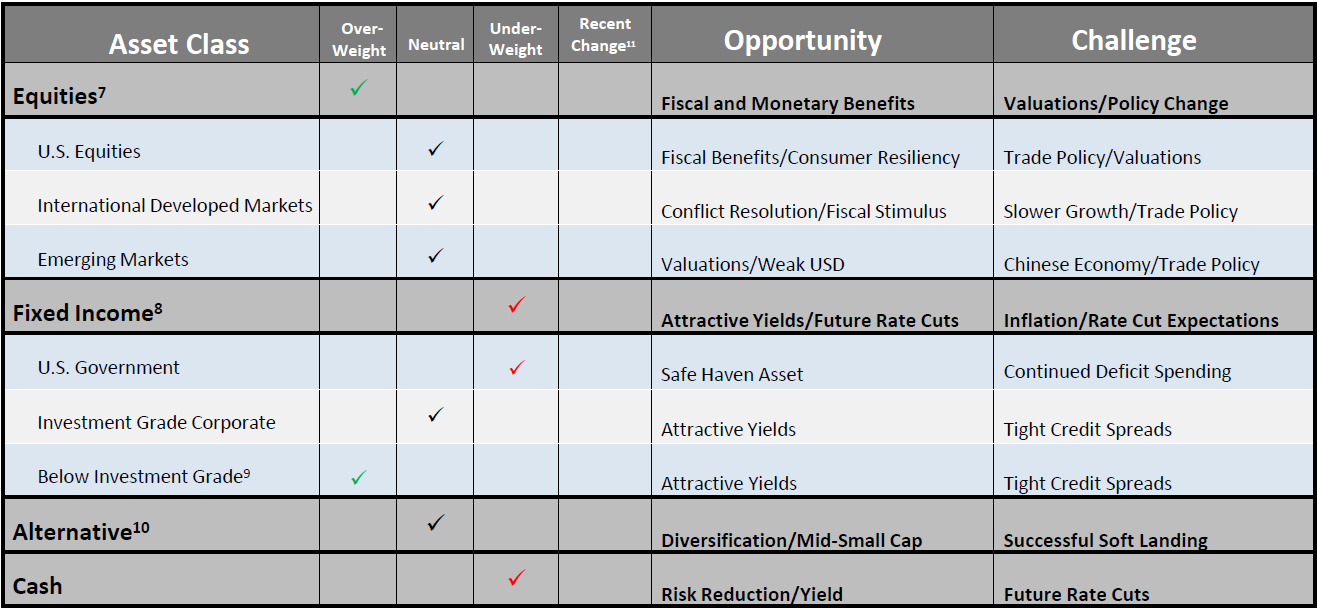

Asset Allocation / Tactical Positioning - November 2025