Markets are rarely predictable, but most would agree that they have been particularly perplexing thus far in 2025. The sentiment from many investors this year has been “I don’t get it. With everything going on, how can markets be trading at all-time highs?” Amid concerns over global trade policy, the US debt downgrade by Moody's, fiscal budget challenges, escalating geopolitical tensions, and the passage of the One Big Beautiful Bill Act (OBBBA), there has been a lot to digest over the last few months.

From where we sit, the ebb and flow of the news cycle in 2025 has required us to quantify the ramifications of each announcement and adjust our assumptions accordingly. Cambridge Trust Wealth Management is not alone in that sense: Wall Street forecasters have raised, lowered, and raised again, forecasts for year-end S&P 500 Index price targets. Another real-time exhibit of these shifting sentiments are the changing odds of a U.S. recession in the next 12 months. On the world’s largest crowdsourced prediction market, Polymarket, the odds of a U.S. recession jumped from 35% at the end of the 1Q25 to 65% after Liberation Day, only to fall to 25% by the end of 2Q25 as the OBBBA passed.1 Given the uneven roll out of the tariff policies, followed by rollbacks and negotiated agreements, and the passage of significant new legislation in Washington, gauging the economic implications of this assortment of varied inputs has been quite the exercise. Yet, markets grind higher, interest rates remain range-bound, and inflation remains largely in check.

As we move into the second half of 2025, we’d like to review last quarter, describe our perspective on the evolving economic landscape and share how we are positioning portfolios in response to both opportunities and risks in today’s markets.

The Surprising Resiliency of Markets

The second quarter of 2025 was one for the history books. Despite a challenging macro backdrop and heightened political uncertainty, markets showed their resilience and delivered positive returns in the first half of the year. The U.S. economy has decelerated from last year’s pace but has defied less sanguine early-year expectations and delivered growth, supported by strong employment, stable corporate earnings, and a gradual moderation in inflation. While headline inflation has declined meaningfully from its peak, progress towards the Federal Reserve’s 2% target remains slow and uneven.

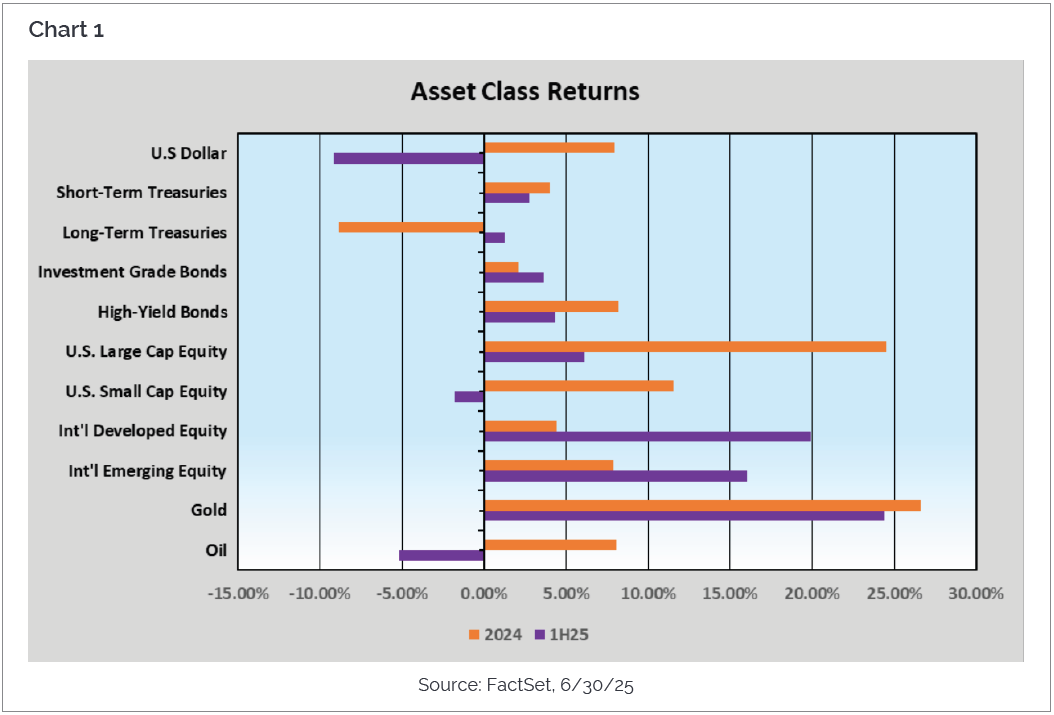

The quarter began with significant uncertainty due to the announcement of new tariff policies by the White House, causing a sharp market downturn in early April. However, a 90-day pause on the most severe proposed tariffs just one week later led to a quick rebound in stock prices. As you can see in Chart 1 below, asset class returns in the first half of 2025 (purple bars) were positive, with the exception of oil and the U.S. dollar, which both declined between 5-10%. Through June 30th, the S&P 500 was higher by 6.2%, developed international equities increased nearly 20%, and emerging markets grew nearly 16%.

The bond market experienced volatility as well, with long-term and intermediate-term rates edging higher due to concerns about the growing U.S. fiscal deficit, while short-term bond yields dropped on expectations of eventual Fed rate cuts. Bond investors earned their coupons and took home low- to mid-single digit returns, with slightly higher returns coming from corporate and high-yield bonds. We believe that bond investors should continue to prioritize income over duration at this time.

Virtually every asset class outside of cash experienced volatile swings during the quarter, with the CBOE Volatility Index (VIX) spiking to over 50, a level not seen since 2022, as policy uncertainty reached a peak. At its lowest point, the S&P 500 was down by 19%; however patient investors saw the market recover by the end of June, allowing the index to finish the first half with positive total returns of over 6%, including dividends. The tech-heavy NASDAQ declined by 24% at its low, but like the S&P 500 regained its footing to finish higher by 5.9% in the first half. Had one tuned out the news from April through June, they’d be none the wiser that the S&P 500 very nearly touched bear market territory (a decline of 20% or more from recent highs). The 2nd quarter served as a textbook example of the importance in avoiding emotional responses to the daily news cycle. While we anticipate continued market volatility, history demonstrates that investors who remain patient and adhere to their asset allocation plans during uncertain periods are rewarded with solid long-term returns.

Interest Rates & The Fed

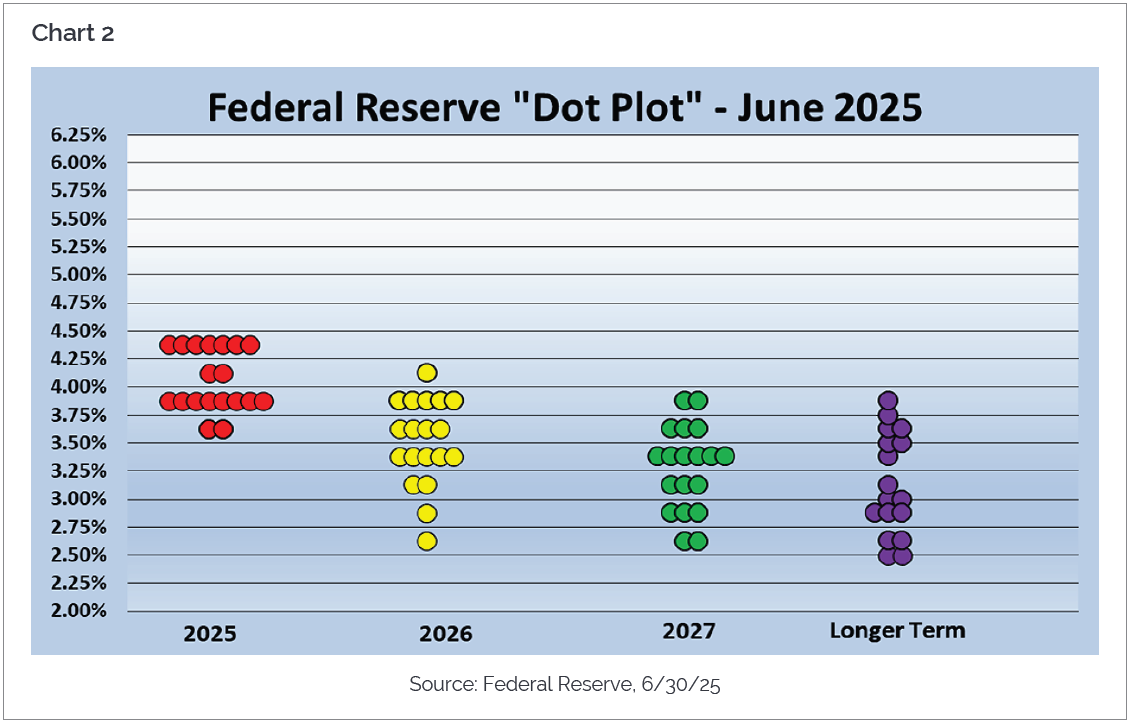

The Federal Reserve has held rates steady year-to-date, but we believe a turn in monetary policy is approaching. Interest rate cuts are now being discussed more openly, provided inflation continues to ease, economic growth softens in a controlled manner, and the job market remains healthy.

The “dot plot” published by the Federal Reserve every three months (Chart 2, above) shows each Federal Open Market Committee (FOMC) member’s projection for the federal funds rate through 2027 and beyond. The current range is 4.25-4.50%, and though the Fed is divided on future rate cuts, the dots indicate that the trend will be lower as we approach the 4th quarter. In fact, during their July meeting, two Fed governors dissented with the current range and voted in favor of a 25-basis point cut; this was the first dissent by two governors since 1993.

More recent rhetoric surrounding the Fed has revolved around President Trump considering removing Chair Powell before his term as Chair expires in May 2026. Most agree that an independent central bank is crucial and that monetary policy decisions should be made without political influence. Yet, the President has been vocal in his message that the Fed has not acted fast enough to lower interest rates and that monetary policy is too tight. For now, the removal of Powell adds another layer of uncertainty and will linger over markets, putting pressure on the U.S. dollar and Treasuries until there is a resolution. Additionally, the next Fed chairperson to be appointed by President Trump in 2026 will likely be more amenable to lower rates, which the market will begin to price in well before any formal announcement is made to replace Powell.

Monetary policy is modestly restrictive, meaning the central bank is holding interest rates higher to restrict economic growth and combat higher inflation. Despite higher interest rates, the Fed’s dual mandate of maximum employment and stable prices, are both in check. The unemployment rate is currently at 4.2%, and inflation is hovering around 2.7%.2 An ongoing concern for the Federal Reserve has been the potential for a second wave of inflation due to the impact of tariff policies and one-off pressures from imports. Given those concerns, the Fed is likely to wait for more data showing that inflation remains anchored before adjusting rates lower. To date, we have seen few signs that higher prices are flowing through to consumer prices, yet the risk remains.

The One Big Beautiful Bill Act: Headwinds or Tailwinds?

On July 4th, President Trump signed the One Big Beautiful Bill Act (OBBBA), a package of tax cuts and spending policies, into law by a razor-thin margin after multiple rounds of Congressional negotiations. At the highest level, the bill has provided a handful of key economic initiatives very closely aligned with campaign promises made by President Trump during the election season.

A top priority of the Trump administration and a major feature of the OBBBA is the permanent extension of the expiring tax provisions within the Tax Cuts and Jobs Act of 2017. The passage of the OBBBA now avoids a large tax hike that was set to begin in January 2026, keeping income tax rates flat at current levels, and removes a level of uncertainty in the second half of the year that higher tax burdens would create a headwind to consumer spending and economic growth.

The bill also fulfills some of President Trump’s campaign promises to end taxes on tips, to eliminate taxes on Social Security and overtime, and to allow tax deductions up to $10,000 per year on vehicle loan interest payments for cars where final assembly took place in the United States. In total, it is estimated that the combination of these items will provide about $80 billion of consumer aid beginning in early 2026.3

Most important in terms of supporting pro-growth initiatives and neutralizing the negative effects of tariffs, the OBBBA introduces several significant corporate tax provisions. In an effort to stimulate more domestic manufacturing and greater levels of reshoring in the United States, the new tax law allows for: 1) 100% expensing of capital equipment purchases; 2) 100% expensing of research and development costs; 3) a more generous corporate interest deduction; and 4) full expensing of factory buildouts. By some estimates, the combined benefit of all these initiatives on corporate balance sheets would be the equivalent of a 7% corporate tax CUT.

Earlier this year, we discussed how, without greater visibility and certainty around tariffs and the passage of the fiscal incentives included with OBBBA, corporations were unwilling to make large capital decisions or commit to any significant projects. With the self-imposed August 1, 2025, deadline upon us and with the announcement of some key trade deal agreements (Japan, European Union, South Korea, United Kingdom, Vietnam, Indonesia), we anticipate a rebound in corporate confidence, which should support stronger economic growth in the back half of the year.

Without question, there is a cost associated with all the major initiatives listed above. According to estimates by the nonpartisan Congressional Budget Office (CBO), in total, the OBBBA is projected to add nearly $3.4 trillion to the national debt over the next decade. This amount is inclusive of net spending cuts contained within the bill that approximate $1.1 trillion. The spending cuts include major changes to the Inflation Reduction Act (IRA) which walk-back renewable tax credits and renewable energy spending, Medicaid, Food Stamps, and student loans. A large portion of the Medicaid cuts do not come into effect until 2028, but the social safety net is shrinking.4

Sadly, the debt and deficit issues are not new; the federal government has run an annual budget deficit each year since 2001, and our cumulative debt levels continue to rise. Higher interest rates would make servicing the debt even harder, putting upward pressure on the federal budget which could squeeze out other spending priorities.

There has been much debate about the financial impact of the OBBBA and its implications on the national debt. The legislation offers substantial tax stability and targeted investment incentives, which may spur long-run economic growth. However, these gains may come at the cost of massive fiscal expansion and erosion of a portion of today’s social safety net, while exposing the U.S. to fiscal stress and credit concerns.

Markets Have Overcome Complexities Beneath the Surface: We Remain Constructive

Global markets have continued to show signs of moderate growth and resiliency. Despite a complex economic and geopolitical landscape, along with the uncertainties around inflation, employment, fiscal and monetary policy, markets have remained relatively calm, reflecting investor confidence in underlying economic fundamentals and continued strong corporate profitability. As a result, diversified stock and bond portfolios have delivered solid year-to-date returns.

In the near-term, we continue to monitor key risks including rising price levels associated with the new tariff policies, sticky inflation that may limit the Central Bank’s ability to cut rates, slower global growth, signs of a weakening labor market, and indications of stress in the bond market as greater debt issuance could cause interest rates to rise.

Eventually, we expect lower interest rates, and less restrictive monetary policy to support the U.S. economy, and in combination with the fiscal tailwinds from the One Big Beautiful Bill, lead to a reacceleration in economic growth in the back half of 2025 and into 2026. Currently, employment remains healthy, retail spending rebounded in June, and the lifeblood of the U.S. economy, the consumer, remains engaged despite concerns of potential inflation ahead.

Given the current environment, we remain constructively balanced in our positioning with a modest overweight posture towards equities and underweights to fixed income and cash. We believe a disciplined, diversified investment approach remains the most effective way to navigate uncertainty. While the risks are real, so too are the opportunities, particularly for investors that remain focused on the long-term.

1Polymarket.com, 6/30/25

2Bureau of Labor Statistics, July 15, 2025

3Strategas, The Summer of Trump’s Next Act: Trade Deals But That Also Means Higher Tariffs, July 7, 2025

4Congressional Budget Office, Estimated Budgetary Effects of Public Law 119-21, to Provide for Reconciliation Pursuant to Title II of H. Con. Res. 14, Relative to CBO’s January 2025 Baseline, July 21, 2025

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of August 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment Products are not insured by the FDIC or any federal government agency, not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC. Residential lending is provided by Eastern Bank, an Equal Housing Lender.