Economy & Markets

- President Trump has remained steadfast in his belief that raising tariff barriers to trade will strengthen the U.S. economy. Economists have cautioned that moving a large share of global manufacturing back to the U.S. will be economically inefficient and time-consuming.

- Financial markets have risen from the depths of the post “Liberation Day” sell-off. This rebound can be largely attributed to the 90-day suspension of reciprocal tariffs for most countries, Jerome Powell maintaining his Fed Chair position through the current term and Treasury Secretary Scott Bessent taking a leading role in economic policy and trade negotiations.

Equities

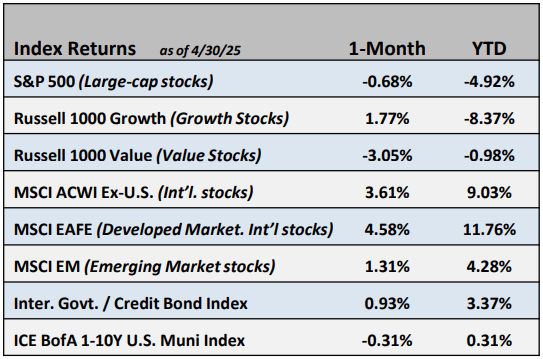

- The S&P 500 experienced a 0.7% decline in April, contributing to a year-to-date decrease of 4.9%. Growth stocks outperformed value stocks, reversing recent trends, while international stocks continued to outpace their domestic counterparts.

- April saw downward revisions to earnings expectations for the S&P 500; however, forecasts still project overly optimistic growth exceeding 9% for 2025 and 13% for 2026. The drawdown in stock prices during the month slightly reduced the S&P 500’s forward P/E multiple to 20.2x, a level that remains elevated relative to historical averages.

Fixed Income

- After rising sharply in early April, yields ended lower for the month as the market digested softer economic data along with the announcement of larger than anticipated tariffs.

- Credit spreads increased to 120 basis points following the tariff announcement and subsequently tightened to finish the month slightly wider than March at 106 basis points.

Employment

- The April employment report was surprisingly strong, showing job growth of 177,000. The unemployment rate remained the same as the prior month, at 4.2%. The anticipated rise in unemployment due to government layoffs has yet to show up in the statistics.

- Businesses have not dramatically reduced payrolls, indicating that they want to hold on to their valuable workers in the face of tariff concerns.

Federal Reserve

- Dual concerns over high inflation levels and slowing economic growth have put the Fed in a difficult position. At their May meeting, the Fed decided to maintain their restrictive policy for the time being. Forecasters now predict three cuts in the second half of the year.

- Forecasts for growth in 2025 on a global basis have been reduced. This is leading to pressure on central banks around the world to lower rates.

Issues to Watch

- Recent thawing of economic relations between the U.S. and China came as very welcome news to global markets. Negotiations between the two countries over the next 90 days will be closely monitored by investors.

- Republicans in the House and Senate are working to pass a tax bill that should renew many of the tax cuts set to expire in 2026. Passage would help allay the concerns of investors about growth in 2026 and beyond.

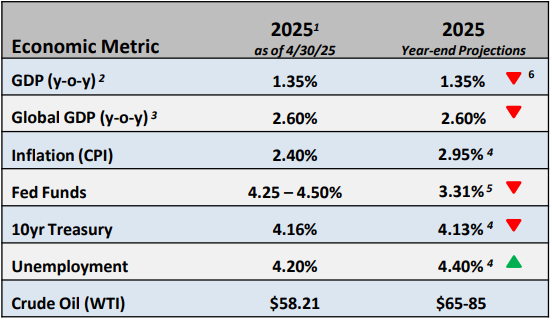

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

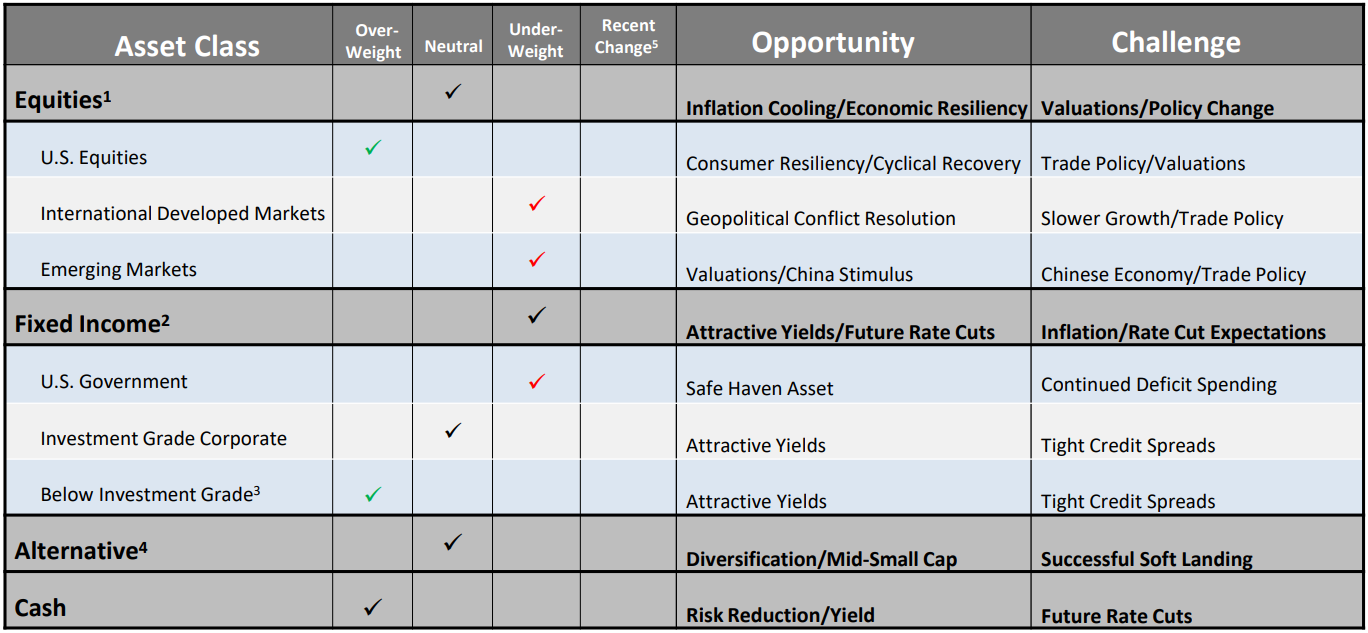

Asset Allocation / Tactical Positioning - May 2025

1 Equity tactical weights are relative to the Cambridge Trust Core Equity allocation and is comprised of 80% S&P 500 and 20% MSCI AC World ex-U.S. Index.

2 Fixed Income tactical weights are relative to the Cambridge Trust Core Taxable allocation and is comprised of 100% Barclays Intermediate Gov/Credit Index.

3 Below investment grade holdings include high yield and emerging market debt mutual funds. Represents an out-of-benchmark allocation that will be reflected as an overweight position relative to the Barclays Intermediate Gov/Credit Index if any allocation is held.

4 Alternative tactical weights represent an out-of-benchmark allocation that will be reflected as an overweight position when utilized and neutral position when not.

5 Direction arrow highlights any recent changes of the overall allocation after a recent tactical asset allocation or strategy change. Last changes were made at March 2025 Asset Allocation Committee meeting.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of May 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment Products are not insured by the FDIC or any federal government agency, are not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC. Residential lending is provided by Eastern Bank, an Equal Housing Lender.