Economy & Markets

- The reality of tariffs and the nature of how they are being implemented is causing investors to prefer the safety of bonds over equities. President Trump has said there will be “short term pain” while he implements his tariff plan. Determining just how much pain will be felt by consumers and businesses will be the focus of investors for some time to come.

- The economic implications of imposing steep tariffs on our largest trading partners is difficult to comprehend, compounded by the volatile nature of current negotiations. It is safe to say that growth in the U.S. will most likely slow from our estimate of just a few months ago.

Equities

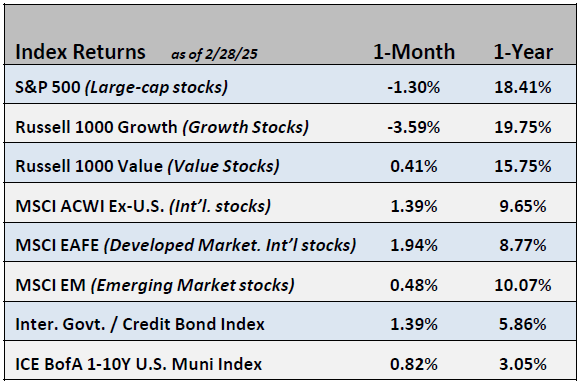

- The S&P 500 declined 1.3% in February impacted by softer economic data and a barrage of policy announcements that heightened market uncertainty. Defensive sectors performed best including Consumer Staples, REITs, and Utilities along with Energy. Value outperformed growth stocks as investors adopted a more conservative stance.

- While Q4 earnings and sales for the S&P 500 continue to exceed expectations, 2025 financial outlooks have been revised downward, albeit remaining strong. At a forward P/E of 21.4x, equity valuations have moderated slightly but remain elevated compared to historical averages.

Fixed Income

- Yields ended the month lower as the market digested weaker economic reports and the implementation of larger than anticipated tariffs.

- Despite increased equity volatility, credit spreads remain historically tight, signaling continued comfort with the economic outlook.c

Employment

- February’s employment report was softer than expected but still showed growth in the U.S. job market. Jobs rose by 151,000 with an unemployment rate of 4.1%. Wages grew by a strong 4.0%, which illustrates the continued demand for workers.

- Government layoff announcements were not fully accounted for in February’s report, so we anticipate more impacts in the March report.

Federal Reserve

- Comments from the Fed continue to reinforce their “data dependent” attitude relative to the economy and the potential for interest rate cuts. Investors will be watching the outcome of their March meeting for signs of potential rate cuts.

- January’s PCE inflation index rose by 2.5%, with the core rate higher by 2.6% year-over-year.

Issues to Watch

- President Trump appears firm in his belief that tariffs will usher in a new period of U.S. exceptionalism. U.S. and global investors are expressing their concern with this policy by reducing risk assets in their portfolios.

- As we wrote last month, 2025 appears to be coalescing around four broad areas, the direction of Employment and Inflation, the impact of Tariffs on the economy and how the Fed will respond to the inevitable cross currents they cause.

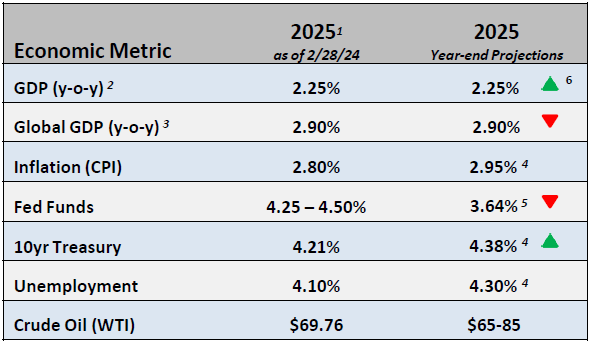

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

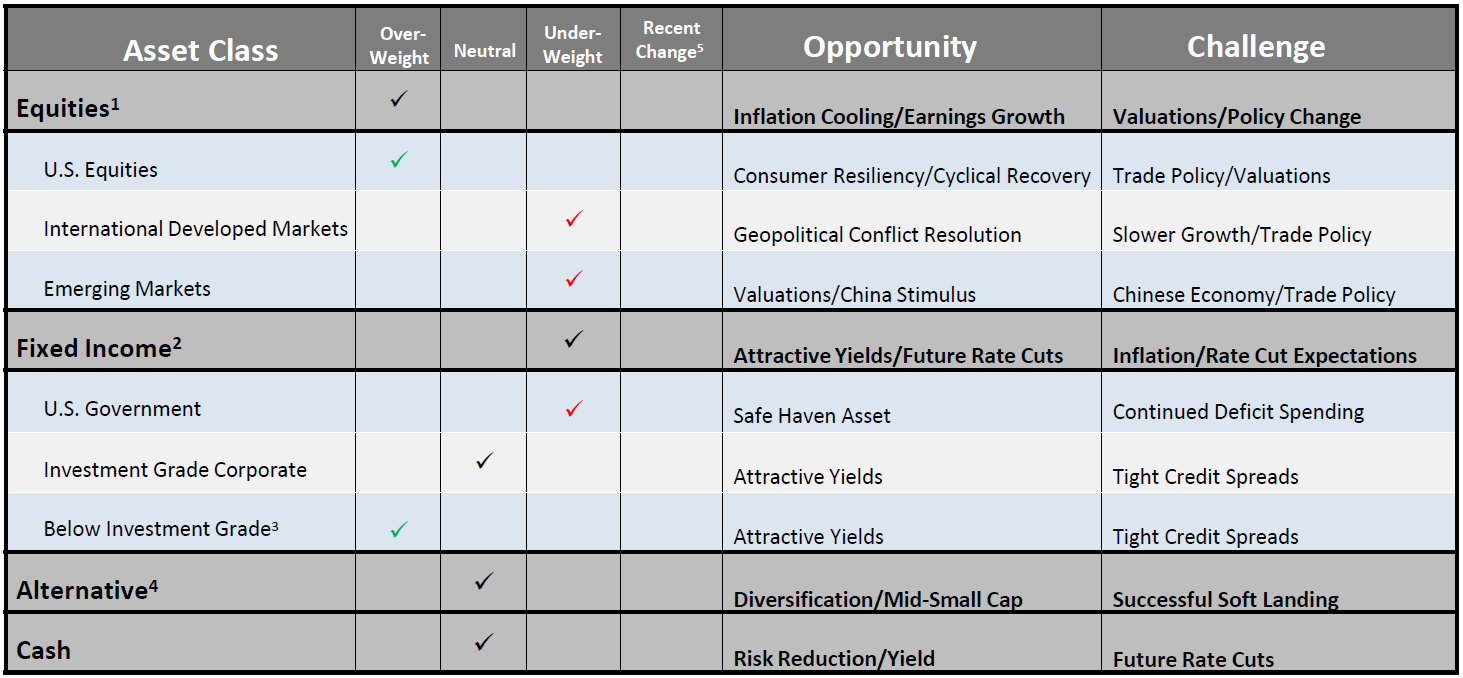

Asset Allocation / Tactical Positioning - March 2025

1 Equity tactical weights are relative to the Cambridge Trust Core Equity allocation and is comprised of 80% S&P 500 and 20% MSCI AC World ex-U.S. Index.

2 Fixed Income tactical weights are relative to the Cambridge Trust Core Taxable allocation and is comprised of 100% Barclays Intermediate Gov/Credit Index.

3 Below investment grade holdings include high yield and emerging market debt mutual funds. Represents an out-of-benchmark allocation that will be reflected as an overweight position relative to the Barclays Intermediate Gov/Credit Index if any allocation is held.

4 Alternative tactical weights represent an out-of-benchmark allocation that will be reflected as an overweight position when utilized and neutral position when not.

5 Direction arrow highlights any recent changes of the overall allocation after a recent tactical asset allocation or strategy change. Last changes were made at January 2025 Asset Allocation Committee meeting.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of March 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, Eastern Bank Wealth Management, Cambridge Trust Wealth Management or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment Products are not insured by the FDIC or any federal government agency, are not deposits of or guaranteed by any bank, and may lose value.