Economy & Markets

- The continued tariff uncertainty, spending cuts for university-based research, and immigration reform has deeply disrupted business spending plans. Orders for new equipment have declined as businesses await clarity on the economic environment ahead. The ISM Manufacturing and Services Indexes are both indicating lower levels of growth in the near-term.

- The MSCI All-Country World Index, an index of global stock markets, has rebounded to a new high in May. Investors appear to believe the worst of the feared “Liberation Day” tariffs will not come to pass or that the global economy will not be pushed into recession because of them.

Equities

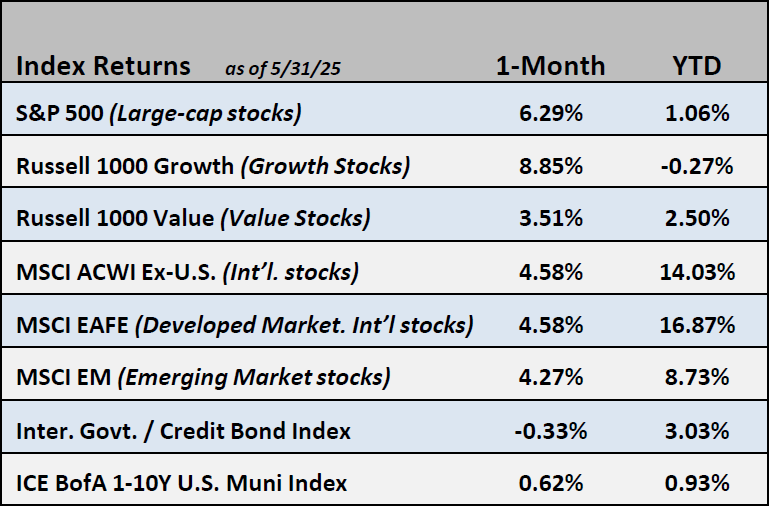

- The S&P 500 rose 6.2% in May which helped push the market’s year-to-date return into positive territory. Growth stocks, led by large-cap technology shares, outperformed value stocks, while domestic equities outpaced their international counterparts during the month.

- The pace of downward revisions to earnings expectations for S&P 500 companies slowed modestly in May. Estimates now call for profit growth of approximately 7% in 2025 and 13% in 2026. The rebound in stock prices pushed the S&P 500’s forward P/E multiple up to 21.5x, an elevated level relative to historical averages.

Fixed Income

- Yields increased this month on better economic data suggesting the Fed may not have to lower rates until later this year.

- Credit spreads decreased to 89 basis points, reversing the credit widening that happened in April following the reciprocal tariff announcement.

Employment

- The May unemployment rate held steady at 4.2%, and a higher than expected 139,000 jobs were created during the month. However, job growth was revised lower by 95,000 for the prior two months and the participation rate fell by 0.2%, to 62.4%.

- May Federal employment fell by 22,000. Over the first four months of President Trump’s term, federal employment has fallen by 59,000.

Federal Reserve

- As inflation continues to slowly decline, the Fed may shift their focus more towards employment. Due to lower immigration, Fed Chair Powell says he believes job creation can slow and not indicate deeper problems for the economy as long as unemployment remains low.

- Expectations for rate cuts this year have fallen to possibly two cuts. The impact of changing trade policies will play an important role in the Fed’s decision-making process.

Issues to Watch

- Negotiations between House and Senate Republicans over the current tax and spending bill are heating up as differences between their respective priorities will have economic and mid-term election implications.

- OPEC agreed to lift crude oil output by 411,000 barrels a day in July. Their production cuts over the last few years failed to raise the price of oil as they hoped. The price of oil is down 13% since the start of the year.

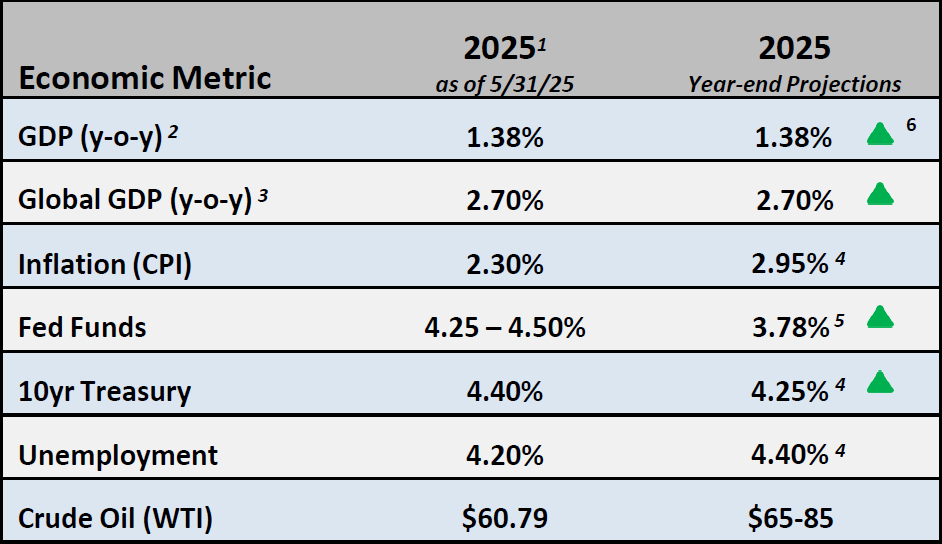

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

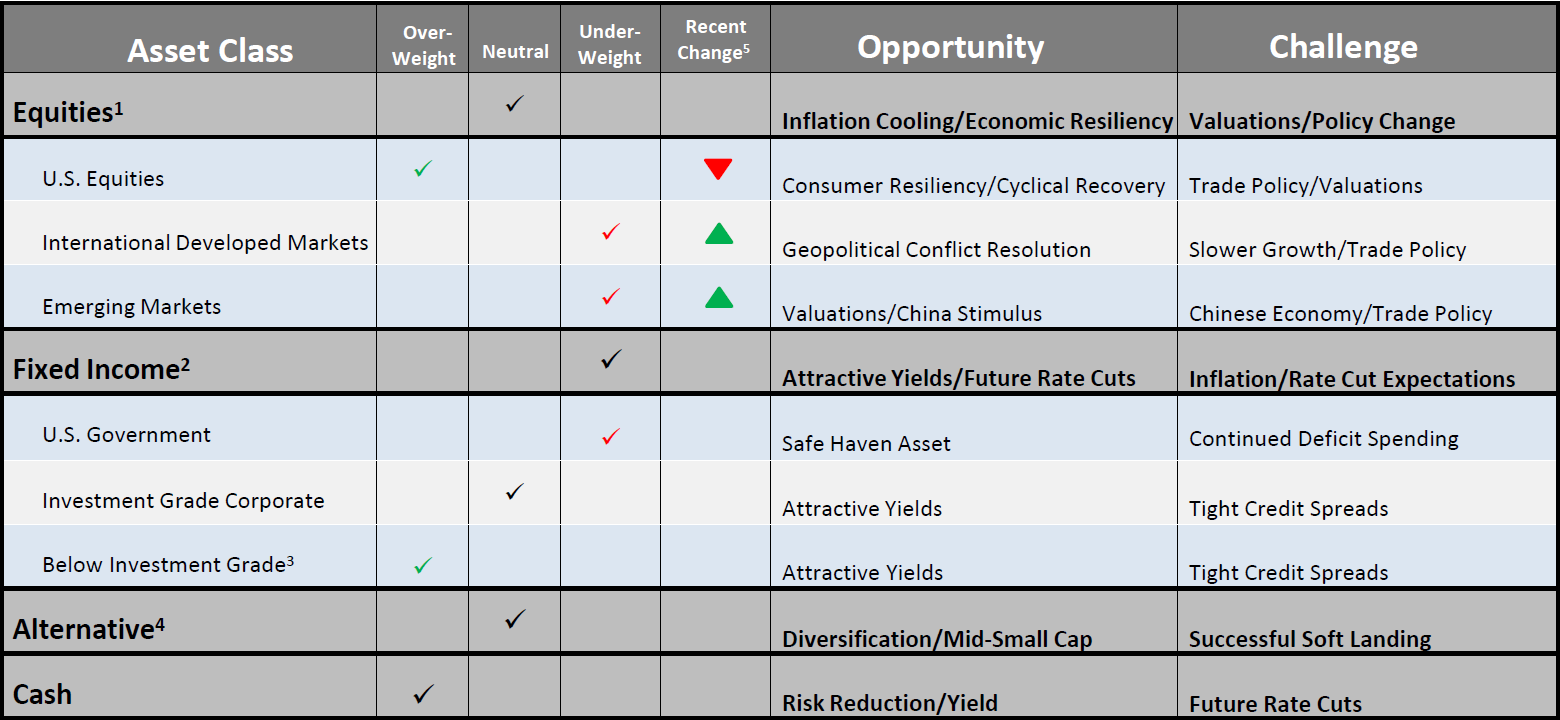

Asset Allocation / Tactical Positioning - June 2025

1 Equity tactical weights are relative to the Cambridge Trust Core Equity allocation and is comprised of 80% S&P 500 and 20% MSCI AC World ex-U.S. Index.

2 Fixed Income tactical weights are relative to the Cambridge Trust Core Taxable allocation and is comprised of 100% Barclays Intermediate Gov/Credit Index.

3 Below investment grade holdings include high yield and emerging market debt mutual funds. Represents an out-of-benchmark allocation that will be reflected as an overweight position relative to the Barclays Intermediate Gov/Credit Index if any allocation is held.

4 Alternative tactical weights represent an out-of-benchmark allocation that will be reflected as an overweight position when utilized and neutral position when not.

5 Direction arrow highlights any recent changes of the overall allocation after a recent tactical asset allocation or strategy change. Last changes were made at May 2025 Asset Allocation Committee meeting.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of June 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment advisory services and investment products are not insured by the FDIC or any federal government agency, not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC.