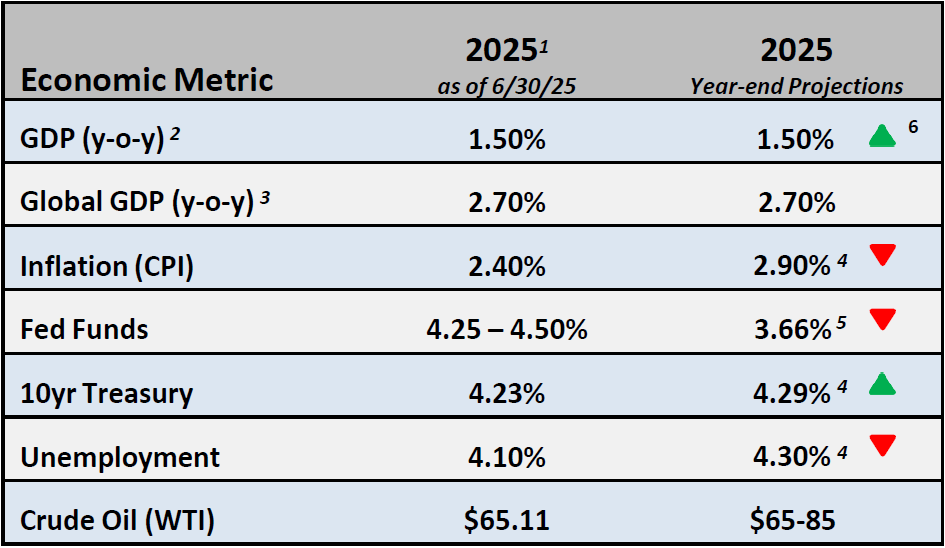

Economy & Markets

- Investors begin the second half of the year waiting for greater clarity in tariff negotiations, watching for signs of increased inflation and finally, whether, and by how much, the Fed will cut interest rates. The 24% rebound in the S&P 500 since the April lows indicates that investors believe the economy will muddle through the impact of tariffs and continue to grow into 2026.

- The Dollar has fallen by 10% so far this year. While down from a historically high level at the end of 2024, this fall, and potential further weakness could put upward pressure on inflation as imports become more expensive.

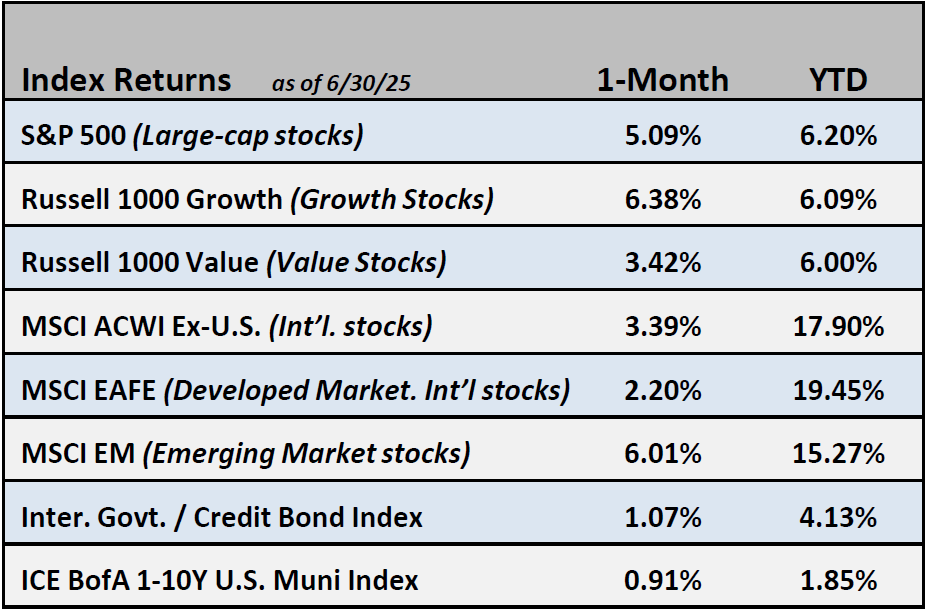

Equities

- The S&P 500 rose +5.1% in June, building on strong performance in May and vaulting year-to-date returns to +6.2%. Growth stocks, led by large-cap technology and communication services, outperformed value stocks, while domestic equities outpaced their international counterparts during the month.

- Revisions to earnings expectations for S&P 500 companies edged slightly higher, reversing the recent downward trend, as worst-case policy outcomes appear to be avoided, and potential tax benefits come into focus. Estimates now call for earnings growth of approximately 8.7% in 2025 and 13.5% in 2026.

Fixed Income

- Yields decreased this month as the market digested economic data indicating the Fed may reduce rates later this year.

- Credit spreads ended the month unchanged at 88 basis points, reflecting the view that corporate balance sheets remain in decent shape.

Employment

- The June unemployment rate fell to 4.1% from 4.2% in May with a higher than expected 147,000 jobs created. The report showed that private employers only added 74,000 jobs, the lowest level since October 2024.

- Manufacturing employment, an area President Trump hopes to see grow, fell for the second month in a row in June. Uncertainty over the impact of tariffs is a primary reason cited for the decline.

Federal Reserve

- Tensions are growing between Fed Chair Powell and President Trump as the Fed maintains its restrictive stance on monetary policy. Investors still hope for two rate cuts this year, but the timing is uncertain.

- The next Fed meeting occurs in late July. Expectations are low for a rate cut at the meeting, but investors are hoping to receive guidance for potential cuts this fall.

Issues to Watch

- The passage of the “Big, Beautiful Bill” has removed a degree of uncertainty as investors sift through the details. A hope is that the stimulative impact of the bill will allay any negative impact from increased tariffs on the economy.

- The 12-day war in the middle east appears to have had no discernable impact on the price or availability of oil traversing the Strait of Hormuz.

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

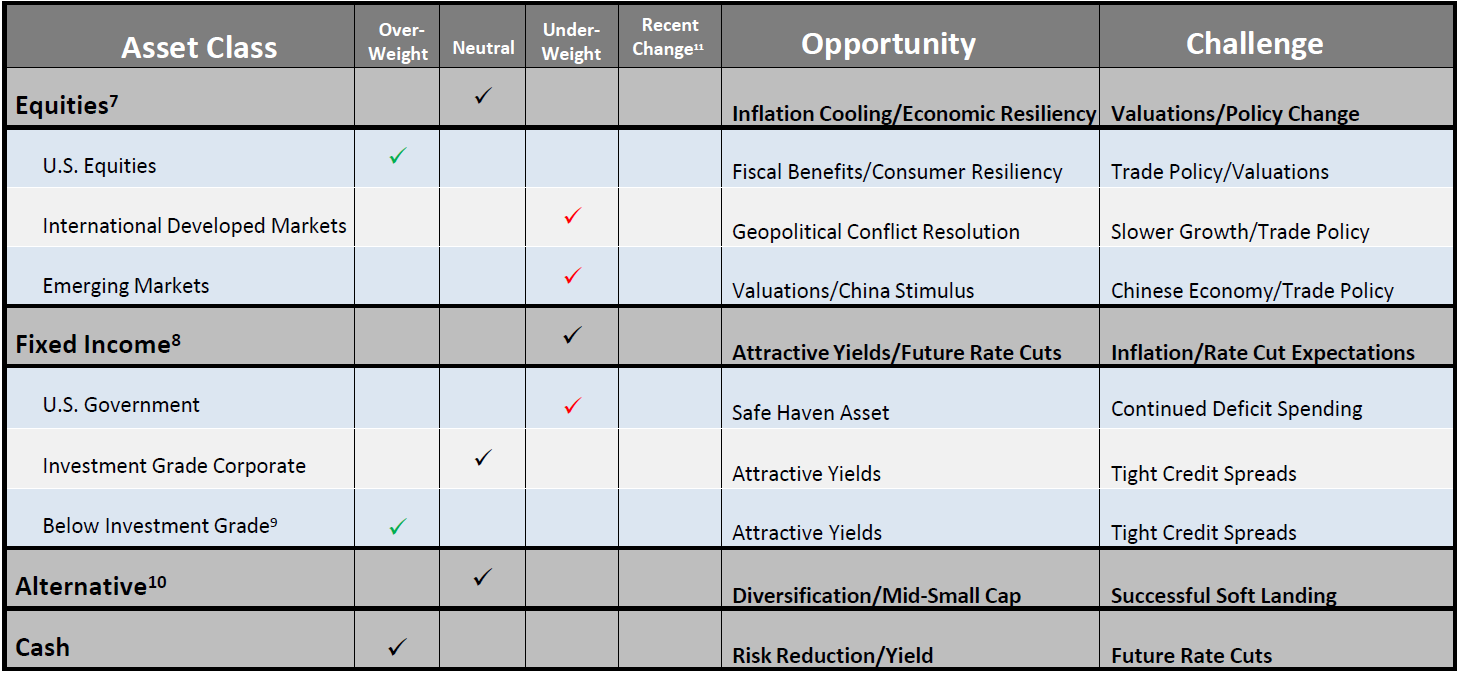

Asset Allocation / Tactical Positioning - July 2025

7Equity tactical weights are relative to the Cambridge Trust Core Equity allocation and is comprised of 80% S&P 500 and 20% MSCI AC World ex-U.S. Index.

8Fixed Income tactical weights are relative to the Cambridge Trust Core Taxable allocation and is comprised of 100% Barclays Intermediate Gov/Credit Index.

9Below investment grade holdings include high yield and emerging market debt mutual funds. Represents an out-of-benchmark allocation that will be reflected as an overweight position relative to the Barclays Intermediate Gov/Credit Index if any allocation is held.

10Alternative tactical weights represent an out-of-benchmark allocation that will be reflected as an overweight position when utilized and neutral position when not.

11Direction arrow highlights any recent changes of the overall allocation after a recent tactical asset allocation or strategy change. Last changes were made at May 2025 Asset Allocation Committee meeting.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of July 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment Products are not insured by the FDIC or any federal government agency, are not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC. Residential lending is provided by Eastern Bank, an Equal Housing Lender.