Since March 23, when spreads on the BofA US Corporate Index widened to 397 basis points, the spread has tightened to 135 basis points, generating a total return of 20%. Interest rates are at historic lows and investors have flocked to lower rated credit to find yield which has driven returns of +15-20% during the recovery after initial pandemic stress. The Federal Reserve instituted both the primary and secondary credit facilities which helped to stabilize the fixed income markets and contributed to these impressive returns. Demand for corporate bonds continues to be robust and corporations have used this low interest rate environment to issue record levels of debt.

Economic activity has slowed because of the COVID-19 pandemic and this has impacted corporate revenue growth. However, not all businesses are equally affected. Several economic sectors are experiencing positive revenue growth, while overall revenue for the index has declined. These dynamics have allowed us to purchase bonds and continue to hold others amid these challenging times. Home Depot and Target were both holdings prior to the beginning of the pandemic. As they have fared well in this environment, we have continued to hold our existing positions as well as added to new portfolios.

The first quarter saw continued revenue growth in Home Depot, up 7.1% compared to the prior year. In the company’s earnings report, management noted that web traffic increased during the pandemic, with online sales increasing by 80%. Home Depot was able to meet the increased demand through e-commerce and saw growth despite reduced store hours and other limitations enforced during the pandemic. It continues to be a well-run company with good profitability as well as strong cash flow generation. Additionally, the positive secular growth trends of do-it-yourself (DIY) home improvement, housing turnover, and household formation are all good trends for Home Depot’s continued strength through recessionary conditions.

Target had similar trends with digital sales growing by 141% in the first quarter and sales up 10.8% compared to the prior quarter. The company saw an impact from the stay-at-home order in customer baskets, with increased demand in goods related to home office, video games, puzzles, etc. Both companies saw leverage increase during the first quarter and operating margins decline from the increased costs of the pandemic, but we remain comfortable with these companies and continue to monitor them moving forward.

A more recent addition to our portfolios was AbbVie. We like AbbVie as the company has a strong pipeline and continues to show commitment to expanding the drug pipeline through the merger with Amgen. AbbVie is also diversified across many different ailments, including rheumatoid arthritis, psoriasis, and HIV, among others. Management is also remaining focused on paying down outstanding debt and keeping cash flow robust throughout the pandemic.

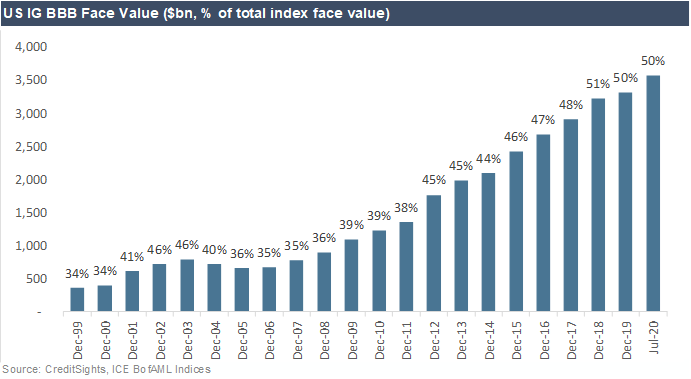

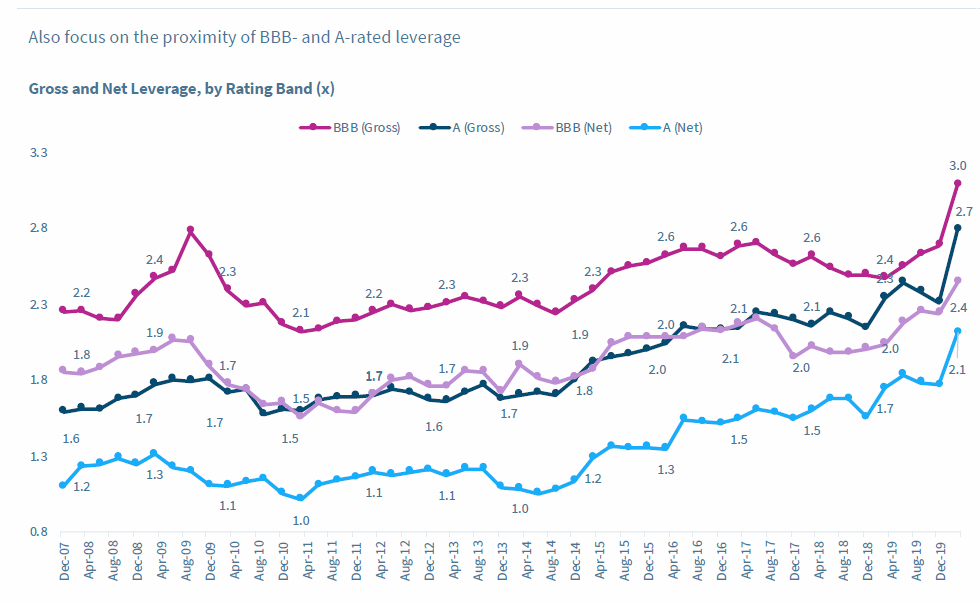

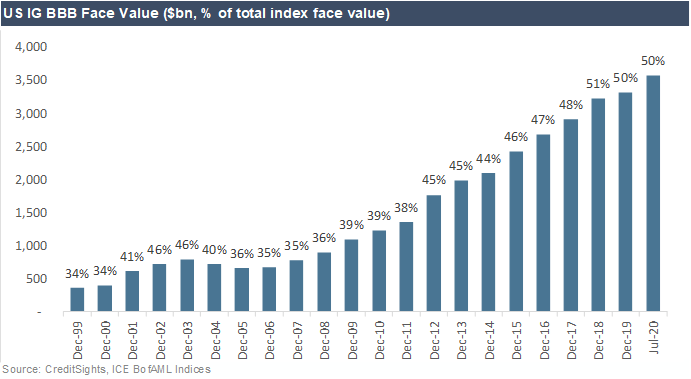

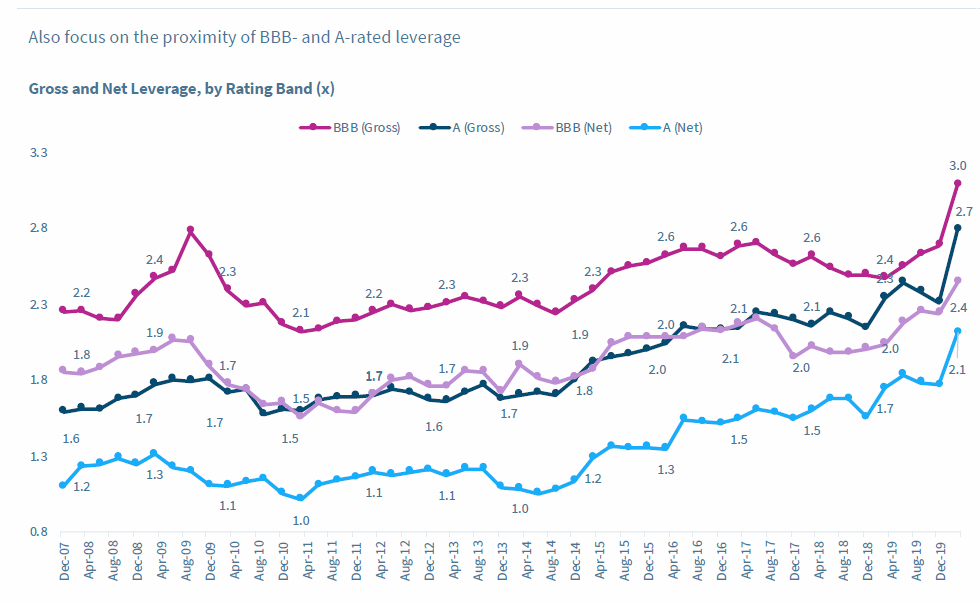

While research can unearth examples of companies with continued opportunity, the overall market remains nervous and stretched, especially at the BBB rating level. Over the past 20 years, the overall index has increased from $1.1 trillion in 1999 to $7.1 trillion today. At the same time, the percentage of BBB rated credits in the index has increased, as illustrated by Chart 1, from 34% of the index in 1999 to 50% today. As corporations have issued record levels of debt, their leverage ratios have also increased. As Chart 2 shows, this ratio has increased faster for BBB rated companies. Passive investment products, such as ETFs, have had to increase their allocations to match the indices, which may pose unwanted risk to portfolios if a wave of downgrades occurs. We have no exposure in any of our strategies to these passive ETFs.

Chart 1

Chart 2

There is some concern within the credit markets that a further deterioration in revenue coupled with reductions to margins from higher costs may result in downgrades to high yield. We remain underweight BBBs in the current environment.

As active fixed income managers, our research strives to uncover companies that we feel have stable or improving fundamentals that can help them avoid credit downgrades. At this point in the credit cycle, we are keeping our risk exposure moderate but are actively researching new opportunities so we will be ready to opportunistically buy on weakness in credits or sectors that we find attractive.