As long-term investors, a key tenet to our investment philosophy is identifying major secular growth trends that are likely to transform business in the years ahead. We believe that identifying these secular themes are the key to long-term value creation. During periods of innovation and the resulting disruptions that occur, incredible opportunities for investment are created. Over the last 25 years, a few examples of secular trends that have fundamentally changed business and industry include the emergence of the internet, the mobile phone, e-commerce, cloud computing, and streaming media. Each of these disruptive technologies fundamentally altered the landscape in which legacy business models operated by introducing new ways of delivering value that are often more efficient, scalable, or aligned with changing consumer behavior.

Today, we are on the cusp of another major secular trend: Generative Artificial Intelligence, or GenAI. Generative AI can create content, solutions, and ideas, ranging from writing and design to drug discovery and software development. This shift will enable organizations to operate with unprecedented efficiency and innovation. As industries from healthcare to finance integrate generative AI into core operations, the technology will become a foundational driver of competitive advantage, economic growth, and societal transformation.

In this Wealth Management Insight, we will provide a high-level overview of GenAI in our Generative Artificial Intelligence: Transformational Technology’s Impact on Investing article.

Artificial Intelligence (“AI”) was once believed to only exist in the pages of science fiction novels, but, in its basic form, AI has been available for decades, with the original concept dating back to the early 1950s. Recent breakthroughs, however, in Generative Artificial Intelligence (“GenAI”) have expanded AI capabilities exponentially. This AI technology inflection has been driven by the combination of ever improving computer technology, availability of huge data sets to train AI models, and major advancements in algorithm development. From Silicon Valley giants to emerging technology startups, aggressive investment in GenAI is now underway, fueled by an eagerness to capitalize on the immense and growing opportunity. This technology revolution has already begun to transform the way we live and work, and numerous public companies are already realizing meaningful growth from GenAI development and deployment, which is translating into significant stock price appreciation. While technology companies are the initial winners with immediate financial benefits from GenAI, a growing range of firms from other sectors are poised to capitalize as well, which will be illustrated by improving profitability and growth – a solid foundation for potential stock price outperformance.

Image generated by GenAI app Midjourney with the prompt to create "a picture of Artificial General Intelligence"

Image generated by GenAI app Midjourney with the prompt to create "a picture of Artificial General Intelligence"

Generative Artificial Intelligence Explained

GenAI is a type of Artificial Intelligence that produces highly realistic and complex content that mimics human analysis and creativity. It can generate output in a range of modalities, including text, audio, images, video, and computer code. It can analyze data and provide insight, recommendations, and solutions, or create new art, music, literature, and games. The quality of what it generates is in many cases similar or superior to what humans can produce and is completed much faster, in seconds or minutes.

How GenAI Works

The foundation of GenAI is a Large Language Model (“LLM”) – an artificial neural network built by machine learning on massive data sets. GenAI learns patterns from existing data, then uses that knowledge to generate new and unique content. Building an effective GenAI model involves two key phases: training, where the model “learns” from large data sets; and inferencing, which uses the trained model to generate responses to unique queries by users. The most common interaction with a GenAI model is users making requests through natural language “prompts” given to a “chatbot” interface, such as OpenAI’s ChatGPT. The more data the LLM consumes, and the more prompts provided by users, the more the neural network learns and can better simulate human reasoning, thereby producing improved output.

A New Transformational Technology and $2 Trillion Market

GenAI appears to be the latest revolution in technology, following the introduction of the computer, the Internet, the mobile phone, and the cloud, all of which were transformational. One of GenAI’s most significant impacts will be boosting labor productivity by assisting or in some cases replacing humans in a wide variety of tasks. GenAI can analyze, automate, and create much faster than humans. Nearly every part of the economy and society will likely be impacted. Morgan Stanley estimates the total AI market could be $1.8 trillion by 2030, growing at a 37% compound annual growth rate. A new industry has formed, and we are in the early years of what is likely to be a decade-plus transformation.

Broad Use Cases for GenAI

GenAI has the potential to disrupt many industries. Some of the earliest business uses currently implemented are in technology, marketing, and customer service. Figure 1 are use cases in development or in practice across a variety of fields.

Real-world GenAI Implementation in Business

GenAI adoption, initially concentrated in the technology and Internet sectors, is surging across industries, driving business model evolution and productivity gains. Fourth quarter 2024 corporate earnings reported earlier this year illustrate tangible benefits from GenAI deployments. RTX Corp.,1 an aerospace and defense company, noted GenAI applications have shortened product testing timelines but importantly meet the same quality standards while using less labor. McKesson,2 a pharmaceutical distributor, is experiencing a boost in customer experience and productivity through GenAI technology aiding in fraud detection and predictive supply chain management. American International Group,3 a global insurance provider, is utilizing GenAI technology to improve underwriting efficiency by extracting quantitative data from files and claims and feeding the information into internal risk models.

1Source: RTX Corp, January 28, 2025

2Source: McKesson, February 5, 2025

3Source: American International Group, February 12, 2025

GenAI Development Roadmap and Ecosystem

GenAI is following past patterns for new tech industry development: breakthroughs in semiconductors, consequent buildout of infrastructure to run the new technology on, followed by development of applications using that infrastructure. The result is a proliferation of the technology across the economy. Figure 2 illustrates this roadmap and breaks down the ecosystem with some of the major players involved.

Companies Leading GenAI Innovation and Buildout

Semiconductors

Nvidia’s graphics processing units (“GPUs”) are providing the cutting-edge compute power for the vast majority of GenAI. Nvidia has seen their revenues (and stock price) more than double each of the past two years due to infrastructure companies purchasing their AI GPUs for the data center buildout. Consequently, Nvidia has rapidly grown into one of the largest companies in the world, with a market cap recently above $3 trillion. Advanced Micro Devices has a small share of the AI GPU market too, and Broadcom’s chips are being used for AI accelerators and the network within the data centers.4

Infrastructure

Enormous amounts of investment are underway to build the AI data centers to train and run the Large Language Models that are the brains for GenAI. Large cloud companies (also called “hyperscalers”) have the scale, R&D expertise, and balance sheets to undertake this huge buildout. The four largest U.S. hyperscalers are Microsoft, Meta Platforms (Facebook), Alphabet (Google), and Amazon, and they alone are estimated to spend over $300 billion on AI data centers this year (illustrated in chart 1, on page 5). OpenAI, Oracle, and xAI are three additional U.S. companies investing heavily in AI data centers. Significant international players, including Alibaba, Tencent, ByteDance, DeepSeek, and Softbank, are also aggressively investing in GenAI capabilities.

Applications

GenAI applications run on the massive LLMs trained by the cloud companies. Applications range from consumer-oriented chatbots to business-oriented copilots and agents. OpenAI released the breakthrough ChatGPT 3.5 product in November 2022, and it became the fastest growing consumer software

product in history, reaching 100 million users in

just two months.5 Google offers AI apps running on

its Gemini model, and Meta offers AI apps running on

its Llama model. Midjourney, OpenAI’s DALL-E, and

Adobe’s Firefly are leading image-generating AI applications.

Microsoft, Salesforce, and ServiceNow are

offering co-pilots and agents within their enterprise

software. A recent IDC survey of global enterprises

showed a strong and growing majority of them are

currently investing in GenAI applications. Companies

that do not invest in GenAI face the risk of losing competitive

position to companies that do and that reap

the productivity, efficiency, and innovation benefits.

GenAI Risks

As with any new technology, GenAI comes with risks. Right away, users of chatbots have found errors in AI responses (sometimes called hallucinations) and biases. Model builders are continually working to improve their AI to limit these issues. Another set of risks involves legal issues – there are concerns over rights to intellectual property as well as privacy rights that could be violated in training the Large Language Models on data found on the web or held by companies. GenAI is vulnerable to nefarious use, such as cyber-attacks and fraud. Finally, this powerful new technology will face regulations by governments around the world. Governments will need to strike a balance between ensuring AI is created safely and responsibly while not limiting necessary technological innovation.

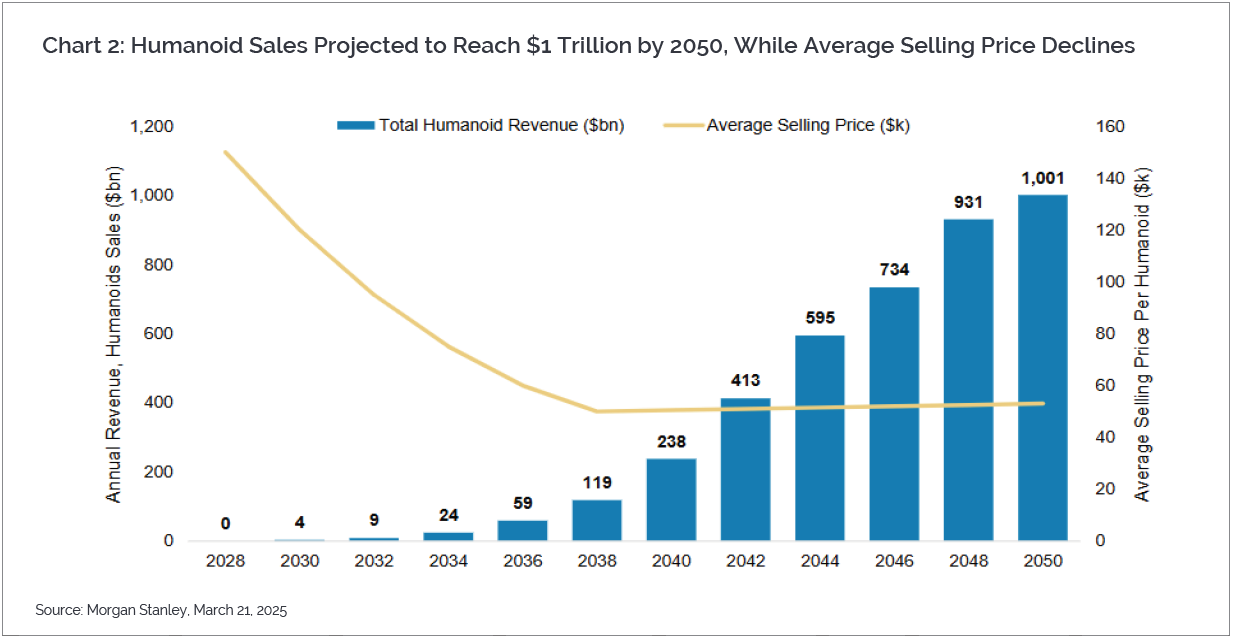

As humanoid production rises, the cost curve will decline, leading to increased adoption and proliferation of the technology.

As humanoid production rises, the cost curve will decline, leading to increased adoption and proliferation of the technology.

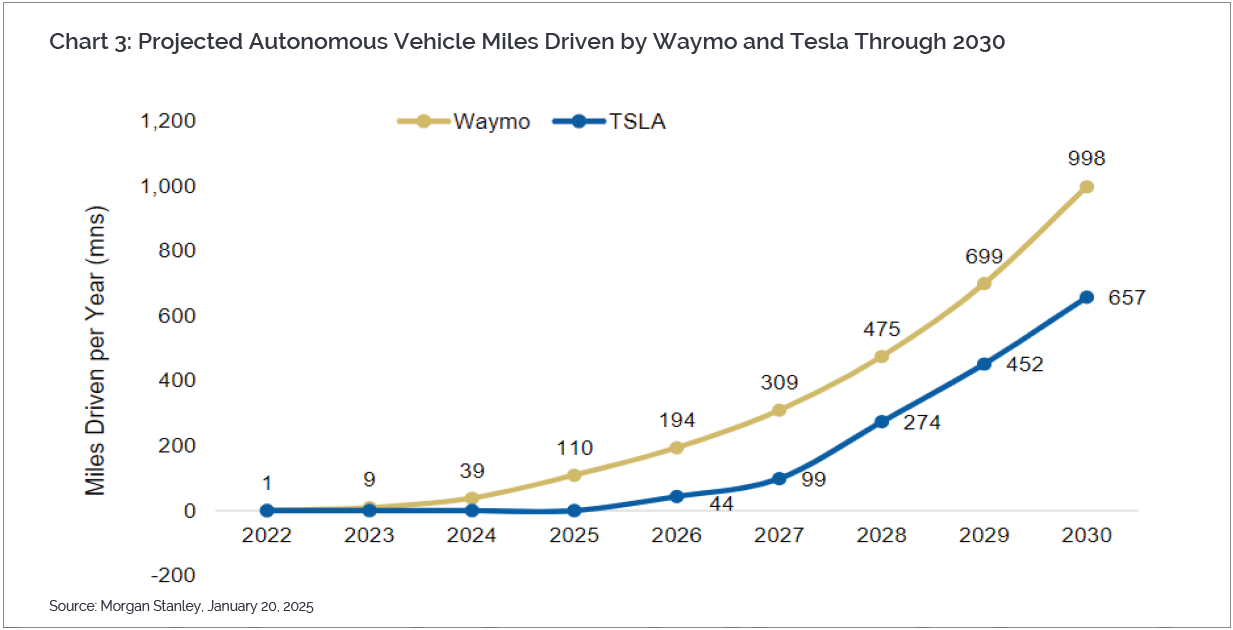

Autonomous driving is a current reality, with Waymo actively launching its services across the U.S., and will surely see mass adoption over the next several years. Notably, Boston is a test city in 2025.

Autonomous driving is a current reality, with Waymo actively launching its services across the U.S., and will surely see mass adoption over the next several years. Notably, Boston is a test city in 2025.

What Comes Next: GenAI is Evolving In Three New Ways

Edge AI

GenAI is coming to smartphones, PCs, and other devices (the “edge” of the network), with in-device neural processors enhancing the AI experience and reducing the latencies in communicating with LLMs in the cloud. Imagine a complete real-time digital assistant on your smartphone, or real-time logistics work being done on-site in industry.

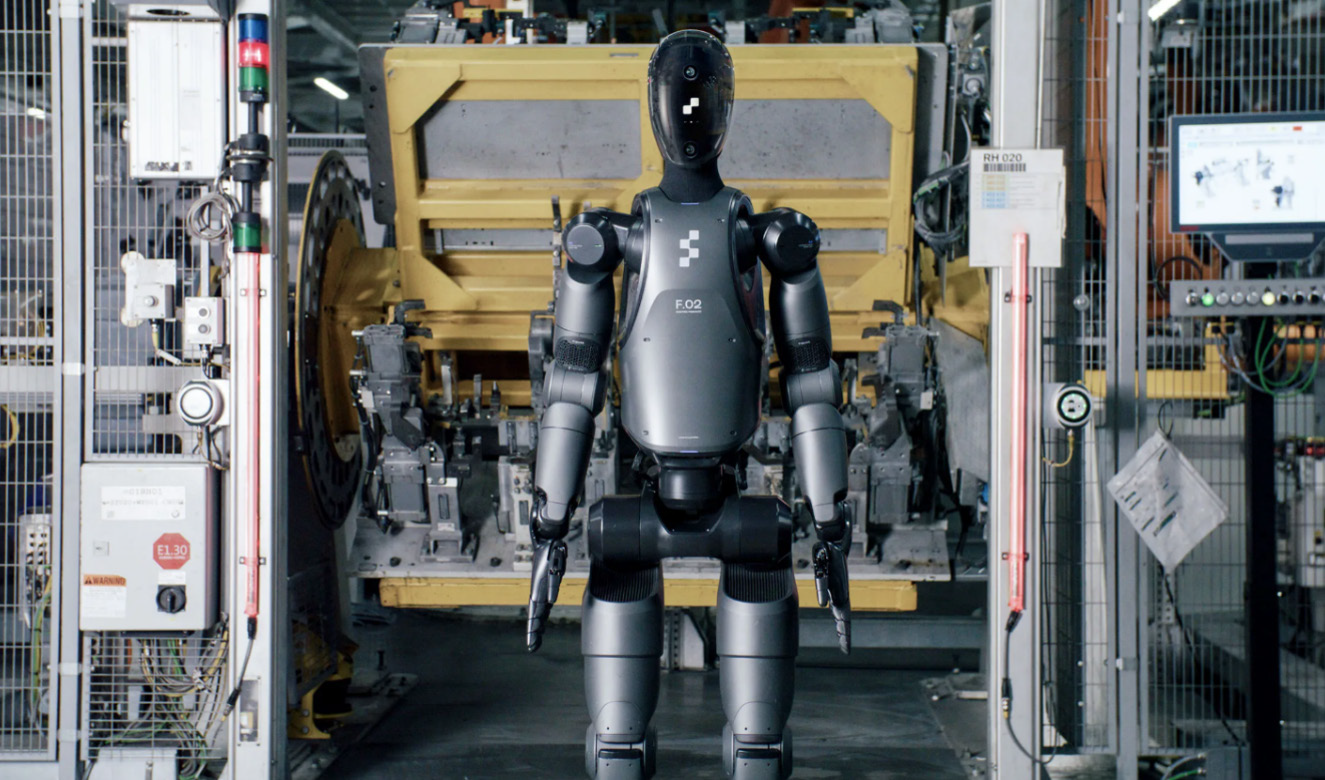

Physical AI

GenAI is now being taught to understand the physical world and it will soon interact with the physical world through intelligent robotics and fully autonomous vehicles. Humanoid robots are being developed that can replace human labor in a range of activities, including manufacturing, construction, service, and elder care. Comically, Rosie the robot maid from the classic cartoon show The Jetsons served as an early vision of an assistant robot. Today’s humanoids may lack Rosie’s charisma but hold significant promise in solving global labor shortages. Several companies in the U.S. and China are near the point of large-scale production of humanoid robots.

Artificial General Intelligence (“AGI”)

Artificial General Intelligence will be achieved when GenAI has equal or greater cognitive abilities than humans, enabling it to reason, solve complex problems, continuously learn, and apply knowledge, logic, and judgement – essentially behave human. At this juncture AGI is still theoretical, but experts anticipate it to be achieved this decade. It could be followed by Artificial Super Intelligence, something that even recently was only dreamed of. These further breakthroughs in the capabilities of GenAI could solve numerous problems that have challenged humanity for many years, such as curing cancer and other deadly diseases, designing smart infrastructure for future cities, solving global poverty, and much more.

Humanoid robot testing last year at a BMW

manufacturing plant.

Humanoid robot testing last year at a BMW

manufacturing plant.

Waymo fully autonomous taxi operating in San Francisco,

CA, September 2024.

Waymo fully autonomous taxi operating in San Francisco,

CA, September 2024.

Exciting advances are currently being made by GenAI in many fields and industries, including medical research and diagnosis, visual arts, technological design, business automation, and others. Edge AI, Physical AI, and AGI will bring GenAI to even more industries and parts of society. Generative Artificial Intelligence more and more appears to be one of the most transformational technologies ever created, with the potential to enhance our lives in many seen and unforeseen ways. The robust infrastructure required to support AI applications and the innovative AI software solutions that meet specific consumer and business needs represent valuable assets that can drive user adoption and ultimately enhance shareholder returns. Investors are likely to realize potential stock price outperformance in companies that profitably build GenAI offerings that address fundamental business challenges and create new market opportunities. Cambridge Trust Wealth Management Equity strategies have positions in many of the public companies using this transformational technology. Our Equity team believes GenAI is a long-term investable theme, and our investment strategies will continue to consider attractive GenAI stocks as this theme develops.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of July 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment Products are not insured by the FDIC or any federal government agency, are not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC. Residential lending is provided by Eastern Bank, an Equal Housing Lender.