To wit, I offer two examples of very different and very humble businesses that have provided strong returns, and one similarly mundane company that may offer the exposure to heady themes often found in much more high-profile packages. These companies offer the tried-and-true hallmarks of successful companies: a strong competitive advantage, solid management, and consistent execution.

One such group of companies that is low on show, but strong on go, are railroads. When many investors think of railroads, they perhaps picture lumbering businesses whose time has passed with stocks to match. Most investors are surprised to learn that railroads have in fact been some of the best, most consistent performers of the last 15 years, outperforming the S&P 500 in 13 of those years. Inclusive of dividends (Union Pacific currently has an attractive 1.85% yield), the railroad sub sector has outperformed the S&P 500 by 624% in the last 15 years, an annualized relative return of 14%. And, while they have faced old economy challenges (the decline of coal), they have managed these large, high-yielding cargo declines deftly, powering through with higher profits and much higher margins.

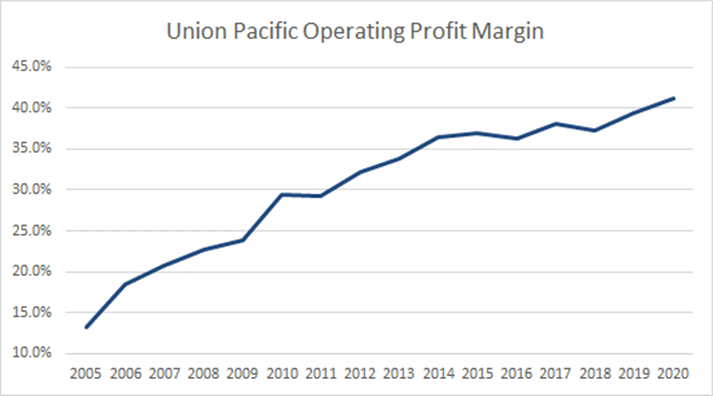

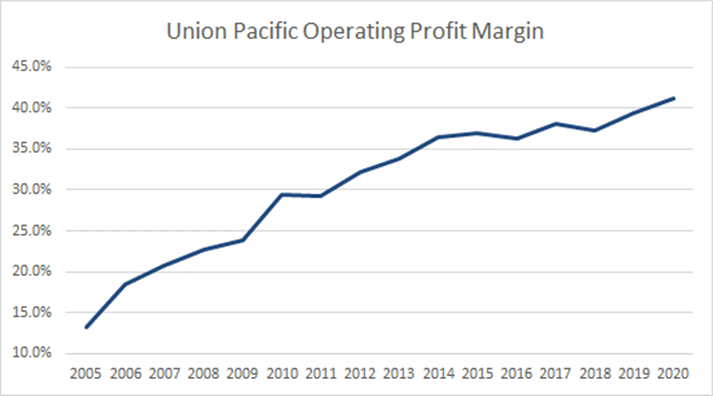

Union Pacific, for example has watched coal transport, its most profitable service, decline in the last 10 years from 20% of sales to 8%, and yet has increased its operating profit margin from 29% to 41% in that period. This has been possible due to the fact that these businesses embody some of the best examples of competitive advantage and wide moats, given the unduplicable assets and the duopolistic nature of their businesses. These advantages make for strong pricing power. This pricing power coupled with savvy operators who have reconfigured the operational scheduling and circuitry of the networks, have made for very impressive margin and stock performance. While the recent radical network reconfigurations may be closer to the end than the beginning for some, the companies’ structural strengths remain. Coupled with attractive dividend yields, these factors continue to make railroads attractive investments.

Source: Bloomberg, Company Filings

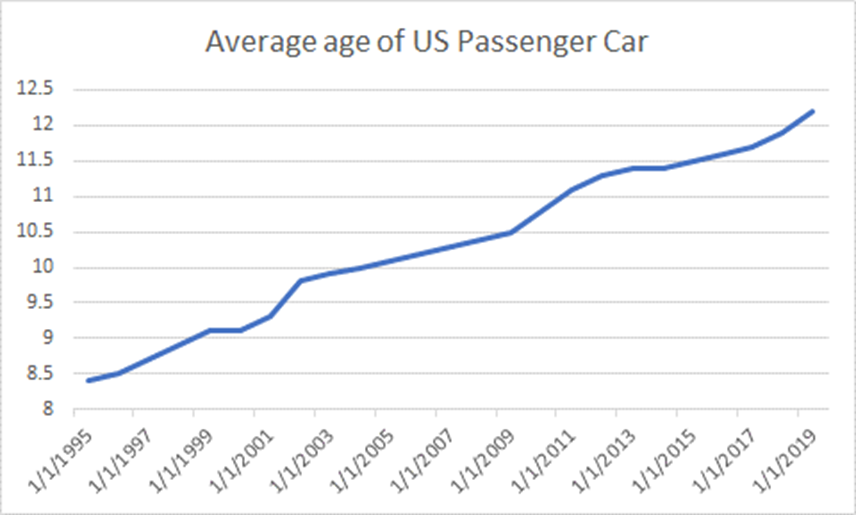

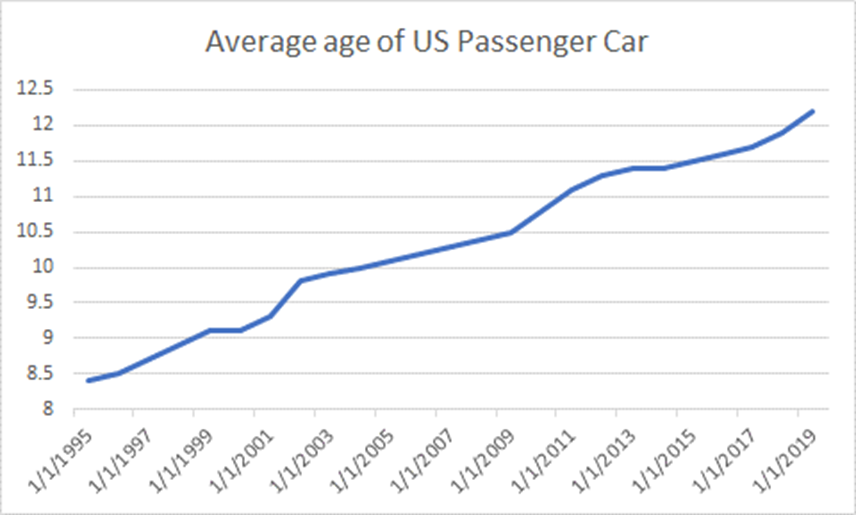

A second company that receives relatively little fanfare, yet whose stock has and should continue to reward investors is O’Reilly Automotive. O’Reilly is a company that is likely known to most households and investors. While their business is less than glamorous, O’Reilly’s financial and stock performance has been quite the opposite. O’Reilly is an auto parts retailer, selling to do-it-yourself and professional mechanics alike. This seemingly sleepy company has a stock that has had an annualized total return of 23% over the last 10 years, outperforming the S&P 500 by 423% over that period of time. The company’s success has been driven by secular tailwinds, solid management, and consistent execution superior to peers. Secular trends have been in the company’s favor, as the average age of automobiles (currently 12 years in the US) has consistently grown through time as cars last longer. As a result of this increasing age, cars require more maintenance and thus parts.

The company has also shown execution superior to its competitors, reaping the rewards of supply chain investment, allowing them to carry/obtain a greater selection of parts more quickly and profitably than peers, resulting in lower prices and better service. As a result, the company has shown revenue and profit performance most would not expect from an auto parts retailer. In the last 10 years, O’Reilly has grown revenues and earnings per share at an 8% and 23% compounded annual growth rate respectively, with EBITDA margin growth of 7.4%. COVID has certainly aided the company’s sales, as the quarantine provided time to spend on do-it-yourself projects and maintenance, making 2020 a tough act to follow for 2021’s growth. However, the reopening of the economy post-COVID should result in people using their cars more to travel to work, visit friends, and vacation, thus driving higher maintenance requirements. Further, the demographics and COVID driven population move from cities to suburbs means an increase in car ownership in the medium/longer term.

Despite these attractive tailwinds and a strong return on invested capital that is ranked in the top 12th percentile of the S&P 500, O’Reilly’s valuation is currently at a 15% discount relative to the S&P 500 on a forward price-to-earnings basis versus its 10-year average of a 26% premium. This combination of secular trends, strong management, and execution coupled with an attractive valuation continue to make O’Reilly a compelling investment. It also highlights how strong growth, financial, and stock returns can be had from understated sources.

Source: R.L. Polk & Co

Exposure to major trends and secular growth themes need not always come from headline grabbers. Opportunities to gain exposure to growth themes can sometimes be had via more mundane companies of quality that sometimes fly under the radar. PPG Industries (PPG) is one such company. PPG is a coatings company, providing paint, coatings, and adhesives for vehicles, houses, infrastructure, and food containers. It is also a company with budding exposure to such products/trends as electric vehicles (EVs), autonomous vehicles, OLED screens, and aluminum cans. In addition, the company’s core businesses are exposed to positive medium-term trends such as a strong housing market and auto demand. While the EV, autonomous, and OLED growth opportunities are not for certain, they provide attractive future potential and when added to the company’s strong core business and reasonable valuation make for a potentially compelling investment. PPG serves as another example of where a relatively unheralded company can be a source of more exciting contents.

Media attention and dramatic stock swings can blind us into chasing the light that high profile and volatile stocks of the day provide. However, a brief look at the railroads, O’Reilly, and PPG illustrates that we can achieve strong consistent returns and exposure to secular trends from surprisingly quiet and unexpected sources.