Economy & Markets

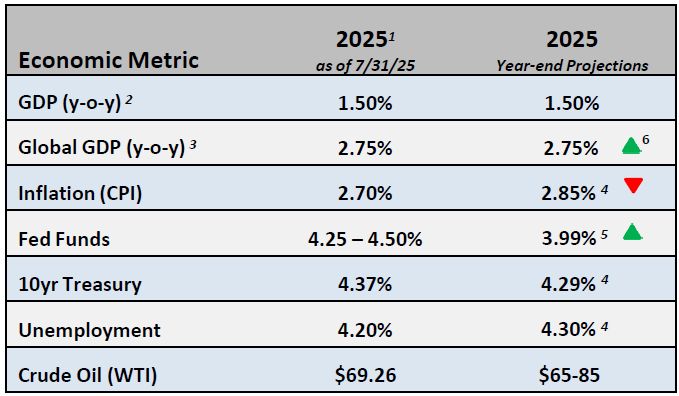

- Mid-year economic statistics point to a deceleration in the economy, stagnation in employment growth, and inflation still above the Fed’s 2% target. In the first half of 2025, the economy has grown at a 1.25% annualized rate, roughly half the growth rate we saw in 2024.

- These challenges have been mostly offset by continued strength in consumer spending and the potential for a resumption of interest rate cuts by the Fed. Equity investors are heartened by the underlying strength of the economy and the potential stimulus from the “One Big Beautiful Bill Act”.

Equities

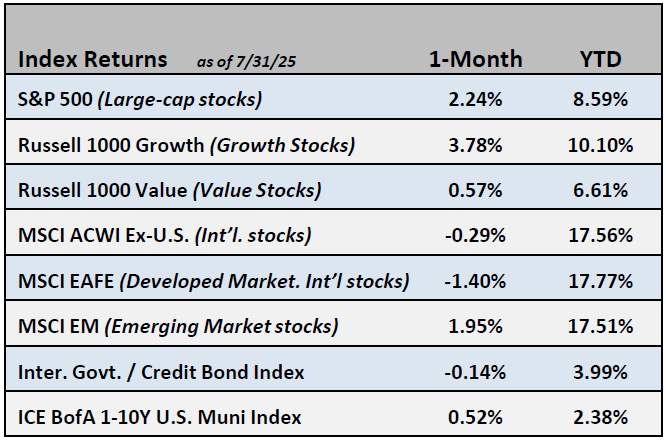

- The S&P 500 gained +2.2% in July as large-cap technology stocks continued their strong run. Year-to-date returns for the S&P 500 finished up +8.6%. The Magnificent 7 helped growth stocks outperform value stocks again while shares of domestic companies finished ahead of their international counterparts, which experienced a modest decline over the month.

- As domestic and trade policy uncertainty recedes, estimates for sales growth among S&P 500 companies remain constructive and call for gains of 5-6% annually over the next three years. Expectations for profit growth remain strong as well at +8% for 2025 and +13% in both 2026 and 2027.

Fixed Income

- The yield curve flattened this month as 2-year rates rose 24 basis points while 10-year rates increased 15 basis points.

- Credit spreads tightened (declined) to 76 basis points, reflecting the view that corporate balance sheets remain in decent shape.

Employment

- The July unemployment rate rose to 4.2% from 4.1% in June with a disappointing 73,000 jobs created. The prior two monthly gains were revised lower by 258,000 jobs. This was the largest two-month downward revision since 1979, except for April 2020 during the covid shutdown.

- While the unemployment rate remains historically low, the number of jobs created is falling and the time to find a job has been lengthening. Announced investments in new factory capacity should support renewed hiring in manufacturing, increasing job creation as the year progresses.

Federal Reserve

- After deciding to hold rates steady at their July meeting, the Fed has been faced with economic data that supports a September rate cut in the opinion of many investors. Chairman Powell said he is focused on the unemployment rate to help gauge the timing of a rate reduction.

Issues to Watch

- Tariff negotiations are still ongoing with China. Complicated discussions over rare earth elements, Chinese purchases of Russian oil and the U.S export of high-end semiconductors have stiffened the resolve on both sides of the negotiations and delayed a tariff settlement.

- Talks over ending the Russian invasion of Ukraine have heated up with a planned summit in Alaska. The threat of secondary sanctions on countries purchasing Russian oil is seen as the catalyst driving recent discussions.

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

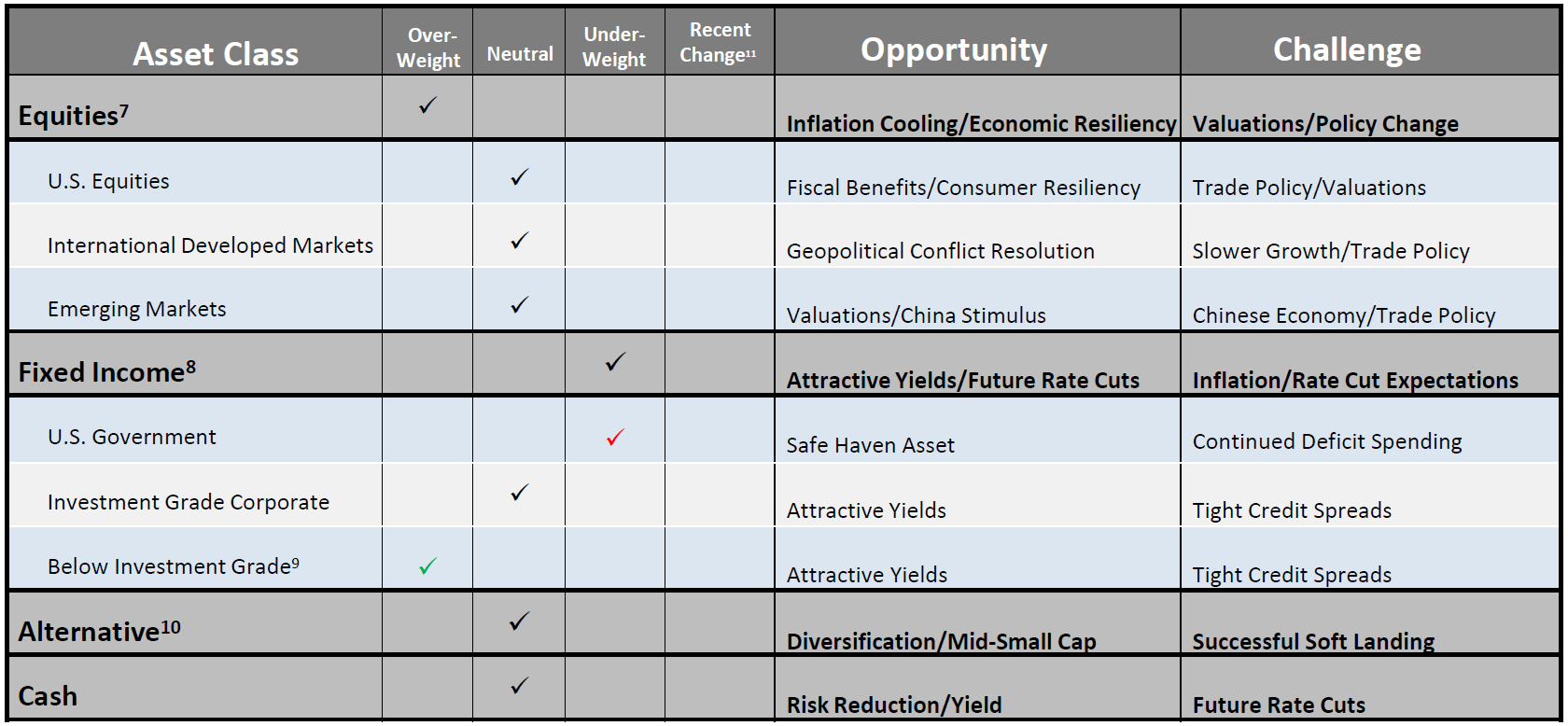

Asset Allocation / Tactical Positioning - August 2025

7Equity tactical weights are relative to the Cambridge Trust Wealth Management Core Equity allocation and is comprised of 80% S&P 500 and 20% MSCI AC World ex-U.S. Index.

8Fixed Income tactical weights are relative to the Cambridge Trust Wealth Management Core Taxable allocation and is comprised of 100% Barclays Intermediate Gov/Credit Index.

9Below investment grade holdings include high yield and emerging market debt mutual funds. Represents an out-of-benchmark allocation that will be reflected as an overweight position relative to the Barclays Intermediate Gov/Credit Index if any allocation is held.

10Alternative tactical weights represent an out-of-benchmark allocation that will be reflected as an overweight position when utilized and neutral position when not.

11Direction arrow highlights any recent changes of the overall allocation after a recent tactical asset allocation or strategy change. Last changes were made at July 2025 Asset Allocation Committee meeting.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of August 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment advisory services and investment products are not insured by the FDIC or any federal government agency, not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC.