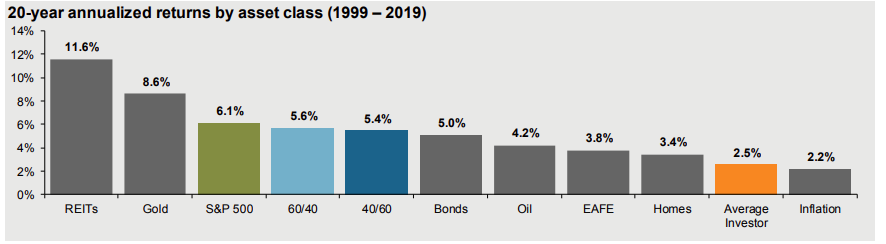

Source: Dalbar Inc., JP Morgan

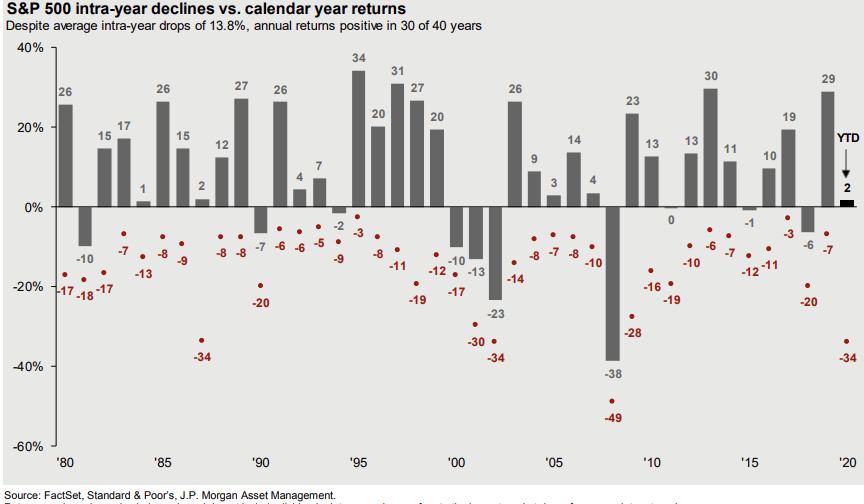

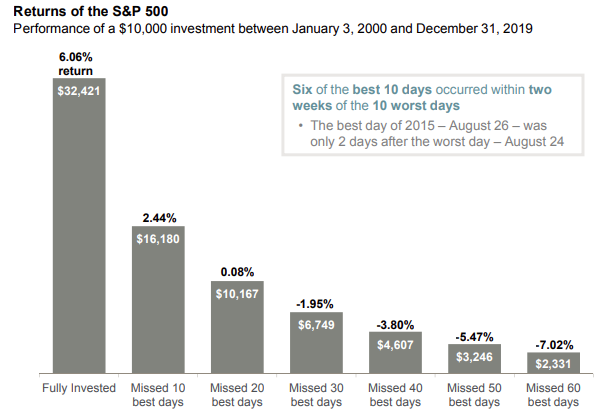

Establishing a well-defined investment strategy and understanding the need to stick to a long-term plan can help investors stay on track when markets become challenging. An important part of an investment strategy generally includes a well-diversified equity allocation, given the superior total return potential over long periods of time. Along with the higher return potential, investors should not lose sight of the inherent volatility associated with equity investing, and not be thrown off course when market volatility heats up, as is frequently the case.