Economy & Markets

- President Trump is not only raising tariffs on trade, but he is also reordering the Post-WWII global economic order. Over the last 80 years there has been a U.S. led push to reduce trade barriers between countries, thereby increasing globalization. The Trump administration believes many countries have taken unfair advantage of this environment and believe their plan will ensure the U.S. is treated fairly.

- The financial markets have responded negatively to the Trump tariff plan because of the uncertainty it has caused in global trade, the potential for higher prices for consumers, and the slowdown it will bring to the U.S. economy.

Equities

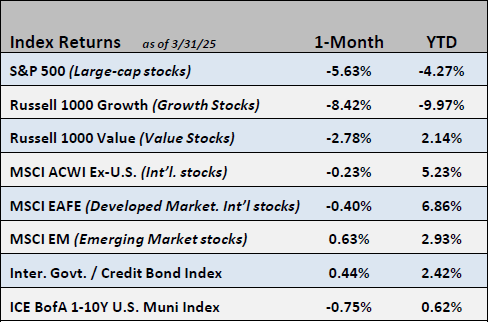

- In March, the S&P 500 declined 5.6% and finished the first quarter down 4.3%. Continued uncertainty around the path of future policy actions cast doubt on expectations for broader economic growth in the year ahead. Value stocks outperformed growth stocks again while shares of companies based outside the United States outpaced domestic stocks.

- Earnings expectations for the S&P 500 were little changed in March and call for 10% and 14% growth, respectively, for 2025 and 2026. The drawdown in stock prices in the month pushed the S&P 500’s forward P/E multiple lower by 1.5 points to 20.3x, a level that remains elevated relative to historical averages.

Fixed Income

- Yields ended the month of March lower but rose sharply in early April as the market digested softer economic data along with the announcement of larger than anticipated tariffs.

- More recently, credit spreads have increased from historic lows, signaling caution as the bond market weighs the impact of tariffs.

Employment

- The March employment report was surprisingly strong, showing job growth of 228,000. The unemployment rate rose to 4.2% due to more people entering the job market. The participation rate rose by 0.1% in March which is a good sign for the labor market.

- Investors are bracing for unemployment to rise as the year progresses due to increased government and corporate layoff announcements.

Federal Reserve

- Rising inflation due to higher import prices will filter through the economy and hinder the latitude that the Fed has to cut interest rates. That said, current expectations have risen for rate cuts this year, from two to possibly four or five.

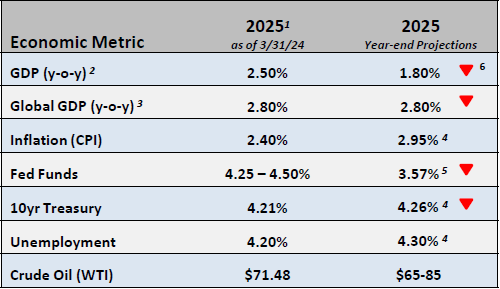

- Forecasts for growth in 2025 have been reduced to below 1% from 2.3% just a few months ago, increasing the odds of a U.S. recession this year.

Issues to Watch

- President Trump has embarked on a global economic reordering with far reaching economic implications with an uncertain end result. Many U.S. allies are upset that they are being treated poorly and may not consider the U.S. to be a reliable partner moving forward.

- The impact of tariffs on employment, inflation, and the economy are difficult to determine but it is safe to say that each will be moving in the wrong direction for investors in 2025.

1 Data provided by Bloomberg. Metrics are as of month-end or most recent publication

2 Provided by U.S. Real GDP Economic Forecast Survey Median

3 Provided by World Real GDP Economic Forecast Survey Median

4 Provided by Bloomberg Intelligence Forecast

5 Provided by World Probability Forecast

6 Arrows represent a month-over-month change

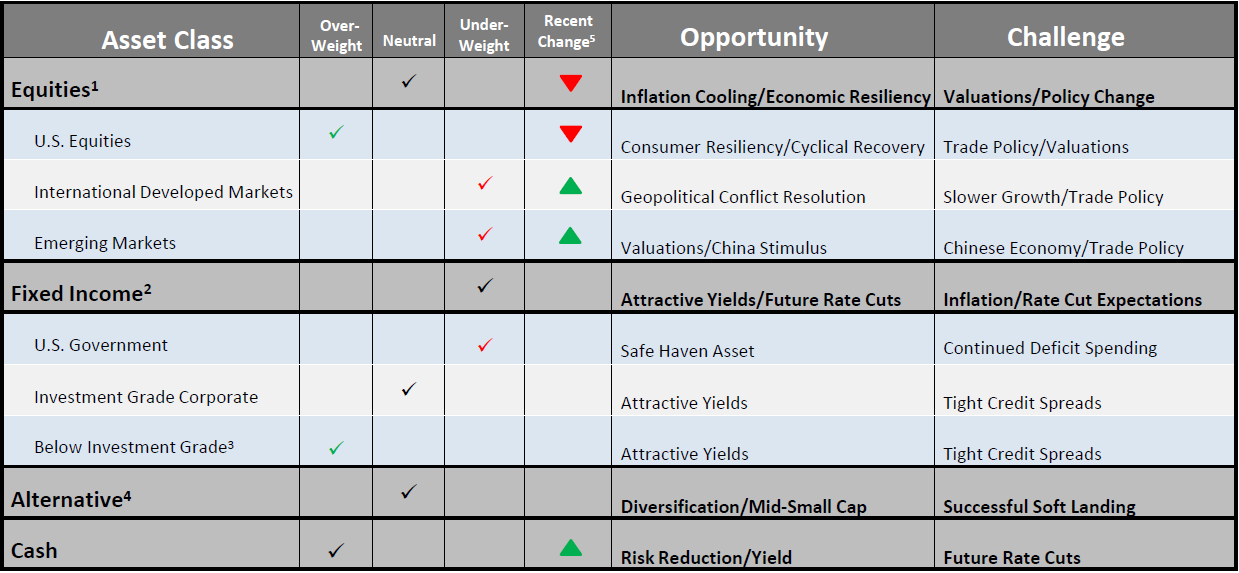

Asset Allocation / Tactical Positioning - April 2025

1 Equity tactical weights are relative to the Cambridge Trust Core Equity allocation and is comprised of 80% S&P 500 and 20% MSCI AC World ex-U.S. Index.

2 Fixed Income tactical weights are relative to the Cambridge Trust Core Taxable allocation and is comprised of 100% Barclays Intermediate Gov/Credit Index.

3 Below investment grade holdings include high yield and emerging market debt mutual funds. Represents an out-of-benchmark allocation that will be reflected as an overweight position relative to the Barclays Intermediate Gov/Credit Index if any allocation is held.

4 Alternative tactical weights represent an out-of-benchmark allocation that will be reflected as an overweight position when utilized and neutral position when not.

5 Direction arrow highlights any recent changes of the overall allocation after a recent tactical asset allocation or strategy change. Last changes were made at March 2025 Asset Allocation Committee meeting.

Cambridge Trust Wealth Management is a division of Eastern Bank. Views are as of April 2025 and are subject to change based on market conditions and other factors. The opinions expressed herein are those of the author(s), and do not necessarily reflect those of Eastern Bankshares, Inc., Eastern Bank, or any affiliated entities. Views and opinions expressed are current as of the date appearing on this material; all views and opinions herein are subject to change without notice based on market conditions and other factors. These views and opinions should not be construed as a recommendation for any specific security or sector. This material is for your private information, and we are not soliciting any action based on it. The information in this report has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is neither representation nor warranty as to the accuracy of, nor liability for any decisions made based on such information. Past performance does not guarantee future performance.

Investment Products are not insured by the FDIC or any federal government agency, are not deposits of or guaranteed by any bank, and may lose value.

Deposit products and related services are offered by Eastern Bank, Member FDIC. Residential lending is provided by Eastern Bank, an Equal Housing Lender.